‘London sellers were more likely than anyone else to sell their home for less than they bought it for’ – David Fell, Hamptons

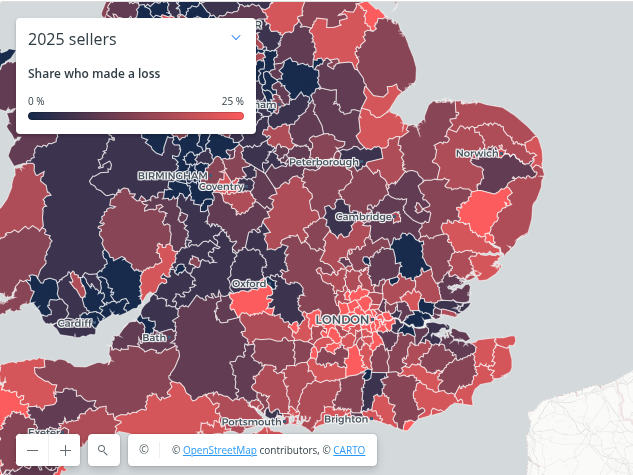

The disastrous state of London resales has been confirmed in a report by Hamptons drawing on Land Registry data showing 14.8% of sellers sold up in 2025 for less than they originally bought – worse even than the North East: the property black spot of the last decade.

The London figures are also far worse than in Manchester (6.7%) or Birmingham (7.3%).

The link is here and includes a nationwide interactive map:

https://www.hamptons.co.uk/articles/2025-seller-gains#

Flat sellers accounted for 60% of London sales last year, but represented 90% of homes sold at a loss.

Even sellers who bought a decade ago face getting back less than they paid – an unthinkable outcome with residential property in the first decade and half of the century.

The trend is confirmed in case studies coming to LKP, where a buy-to-let investor bought a £175,000 flat in Feltham, south east London, and a £220,000 flat in Wimbledon, in south west London.

Both sites have cladding issues, and as a Non-Qualifying Leaseholder under the building safety regime, the investor is haemorrhaging cash on waking watch etc.

Auctioneers estimate the flats’ values now at £70,000 and £130,000 – a £195,000 loss.

This article by Joe Douglas, a resident management company director and a leasehold reform activist, lays out the despair of being a Help-To-Buy leasehold flat owner in the capital: of how doing everything that society wanted of a young professional – taking a first step in having a material stake in it – has blighted the lives of him and his partner to the point that it has stopped them considering having children.

News on the Block | Apartment Building Management Resource

News on the Block | Britain’s Best Apartment Building Management Resource | over 7000 pages including advice on leasehold, service charges & enfranchisement

The author of the Hamptons report, the firm’s lead analyst David Fell, says that as recently as 2019, 29.9% of North East sellers sold for less than they paid compared with 9.2% in London, reflecting the region’s slow recovery from the 2008 financial crash.

But loss-making sales in the North East fell to just 13.9% in 2025.

In contrast, London’s figure has risen markedly.

Hamptons says: “This trend has been driven largely by flat sellers who, despite accounting for 60% of London sales last year, represented 90.0% of homes sold at a loss, up from 78.4% in 2019.

“Last year, 28.2% of sellers in Tower Hamlets [which has the highest density of flats second to Westminster] sold for less than they paid, the highest figure in both the capital and the country, with flats making up 90%+ of all sales in the area.”

The City of London (26.2%), Kensington & Chelsea (22.4%), Westminster (22.1%) and Hammersmith & Fulham (20.8%) complete the top five local authorities where more than a fifth of sellers sold at a loss in 2025. Meanwhile, in Barking & Dagenham – London’s cheapest borough – just 5.3% of sellers sold below purchase price.

Hamptons says: “While the average London seller in 2025 still achieved a price of £172,510 (44.6%) above what they originally paid, most of this uplift stems from historic house price growth.”

Half of London sellers last year had owned their home for more than a decade, which accounted for 77% of the total gains.

It gets worse:

“Over the next few years, more sellers are likely to have missed out on London’s 2012-16 house price boom, having bought instead at what turned out to be the top of the market. That could make trading up increasingly challenging.”

House owners recorded higher gains than flat owners: 59.6% over an average of 10.3 years, compared with 35.4% for flats over a similar 10.1 year period.

Hamptons says: “London house sellers were more than six times less likely than flat sellers to make a loss (3.5% vs 22.2%). This widening gap has made it increasingly difficult for flat owners to bridge the step up to a house.”

It adds: “Across England & Wales, 8.7% of sellers in 2025 got back less for their property than they originally paid, down slightly from 8.8% in 2024. However, this figure masks a sizeable divide between property types: 19.9% of 2025 flat sellers sold at a loss, compared with just 4.5% of house owners, down from 5.7% in 2024.”

“The recent slowdown in house price growth nationally is likely to reduce the uplift homeowners achieve when they come to sell in the coming years. But for many, moving remains a discretionary decision, heavily influenced by the value they can achieve.

“If the numbers don’t stack up – and sellers risk losing part of their original deposit – many choose to stay put. This means some homeowners, particularly those unable to secure a gain, are likely to remain out of the market.”

Ex-minister Justin Madders becomes co-chair of APPG. Full list below:

Ex-minister Justin Madders becomes co-chair of APPG. Full list below:

Leasehold ownership is clearly a depreciating asset in respect to the above detailed analysis. Oh dear.

Many leaseholders whose blocks are managed by an RMC, RTM, or who have a share of freehold, and whose ground rents are modest and unremarkable, may feel that some of the aggressive campaigning has been counterproductive. The perception among buyers—particularly first-time buyers—is that flats are universally problematic, regardless of the ownership or management structure.

Introducing commonhold is likely to create a two-tier market, forcing RMCs, RTMs, and share-of-freehold arrangements to incur significant costs simply to rebrand themselves as commonhold, while seeing little, if any, tangible benefit.

What is needed is a calmer, more measured debate. Proposals to cap all ground rents at a peppercorn, for example, do little to foster the mature, nuanced discussion the sector requires.

Are you a freeholder per chance?

Stephen is indeed one of the ‘businessmen’ involved in perpetuating the leasehold system. You can find him on practically every public forum repeating the same tired old arguments almost verbatim.

Stephen,

Are you a Leaseholder, and If so, what are your ground rent terms and what is your service charge demand ?

Both our Daughters and eldest Grandson had the good sense to avoid buying a Fleecehold tenancy thus avoiding being potentialy “robbed blind” through the duration of the limited lease duration by the Fleeceholder.

They avoided the often “extortianiate” unjustiefied service charge and the dreaded “deficit letter” which are often sent with out supporting evidence and are sometimes as clear as “mud” in terms of justification and or even basic explanation.

The current Fleecehold system resembles the ” WILD WEST” according to certain Ministers of State.

Radical charge is very long over due and the exploitation of those with limited incom must be ended in respect of satisfying the insatiable GREED of some FLEECEHOLDERS

From The Guardian “The measure (capping ground rents) was part of a draft leasehold bill due to be published last year, which was delayed after (Rachel, The Chancellor) Reeves became concerned that capping ground rents could deter property investors”.

When something is wrong, it is wrong and the very existence of leasehold is not only wrong it is wrong on stilts. The socialist(?) Rachel Reeves wants ordinary hard working people to finance rich property developers. If my blood wasn’t already boiling, it would be boiling over and flooding the kitchen.