Of all those caught up in the cladding and building safety scandal, few (apart from freeholders) excite less sympathy than investors in multiple flats: more than three investment properties of any type and you pay for the remediation yourself.

This is the government’s view: if you are an owner occupier or small scale buy-to-letter, we will help you out; if you own multiple assets then, sorry, but you have to pay yourself.

That’s tough, because they are paying for other people’s mistakes.

But I have been a bit stone-hearted on this issue myself, being in despair at the turning of housing into an investment asset as opposed to a social need. I have been a long-term critic of the baby boomer generation piling into residential property which I knew would have awful social consequences in the early days of our property madness from about 2002.

It could reasonably be argued that just like those – me, for instance – who punt on the stock market, investors in flats should take the consequences when their bets go wrong.

On the other hand, a UK-based pensioner, as here, who owns five flats is rather different to one of the private equity groups hoovering up residential property usually through an offshore third party.

Anyway, you can decide whether this little account inspires compassion, or not:

Here is an email to LKP from one of them:

I “own“ five properties – and when I say “own” I, of course, mean having five mortgages, all having risen astronomically since December last year and where they are leasehold (three) insurance premiums have virtually doubled in that time.

It is now the case that rental amounts do not cover mortgages or service charges so I am in the red every month.

Raiding my pension pot looks like being the only way to pay the difference. This was something I was prepared for, but hadn’t realised that I would be exempt from being covered for cladding and associated remedial costs due to having five mortgages rather than three or less.

One leasehold building is already due to have its cladding replaced with much other defective works to take place. The survey has just been completed, but costs and programme of works not yet clarified. One other leasehold property has already had a fire break out and I am not clear if defective works needed there too. What I am not clear about yet is if there is a cap to what I would be required to pay being one that doesn’t qualify for exemption to pay for remedial works or if I would have to pay the full percentage of costs as laid out in my original lease document?

As costs will run into millions, if I have to pay a non-capped figure in one or two cases, then I will be made bankrupt. Basically my pension pot is my savings.

I have yet to complete a deed of Certificate in all cases as it seems pointless if I am exempt; do not qualify.

I would be interested to know what LKP’s opinion on the situation of ‘cut off’ for those who have more than three properties – like me, I expect most are mortgaged to the hilt and paying greater interest rates, being BTL mortgages.

It seems a ‘perfect storm’ of disasters that can only lead to bankruptcy. It’s all hugely depressing as I cannot see a positive outcome given being attacked on all fronts.

In respect of my apartment where Barratts were the original developer and have agreed to carry out all remedial works, from recent meetings it is now likely that late 2025 or even into 2026 will see the works completed. And we will be one of the first in the queue!One positive note – if declared bankrupt they cannot touch your pension pot unless you withdraw amounts from it and then become subject to making payments towards your debt. If one can last four years from date of bankruptcy then after that date the liability no longer exists – obviously there are other issues/bad credit ratings etc…

One can transfer any savings from an ISA for instance into pension and have that money protected. The downside being four years of no savings and living hand to mouth, month to month.

I suppose it is worth recalling how abnormal our obsession with hyping the value of residential property is.

For the best part of two decades, boomers who had assets would borrow at then absurdly low interest rates that younger first-time buyers simply could not obtain (and write off this cost as a business expense, naturally). This is, in turn, set off asset inflation in houses and flats that persisted for year after year.

The pre-2008 years were the best, or rather worst, for our obsession with residential property as an investment is toxic.

This was the time when I was being taken to lunch by the boss of the British Property Federation to be told that subsequent generations would live their lives and raise families in rental properties – just like Germany – and wouldn’t this be wonderful, especially for labour mobility?

At the same time, houses in Chelsea were going up in value by nearly 40% a year: a staggering increase in the wealth of home owners who had simply got lucky.

I replied that I did not think it was wonderful. That if you exclude the young and talented from a material stake in society they will help themselves to it. That’s in good measure what the events in France in 1789 were all about.

Facing unequal competition from boomers at home, things got worse for first-timers when the rest of the world grasped what was going on and began piling into UK resi property as well.

It got to the point where you are a bit of a dumbo in Singapore, Taiwan or Shanghai if you didn’t have some (largely tax-free) resi bolthole in the UK.

And the property sector loved it, with sales teams flying out to shows in Dubai, Singapore, Hong Kong and Shanghai. I think the Savills Singapore office was one of the most lucrative of the lot. The influential Berkeley Group, which built London’s Thamesside palaces, would virtually sell out some of its sites to overseas buyers.

I was one of the very few journalists – in the Mail – urging bans on non-resident investors similar to Switzerland or Denmark.

Nothing could be worse for an economy long term than for investor money to drain away into endlessly inflated values for flats and Victorian semis, rather than to go to innovative businesses.

But the government loved it. Oldies in the Conservative voting shires got used to their homes ballooning in value: a tax-free hike in asset values that made any other pension planning redundant.

Never before had the residential property sector had such a dominant hold on the Conservative party, seen pretty clearly in the list of leading donors.

Right to buy was endlessly expanded, even though it now seems that around 40% of former council flats are owned by various sorts of property investors.

But government – New Labour and Tory – thought everything was going just swimmingly.

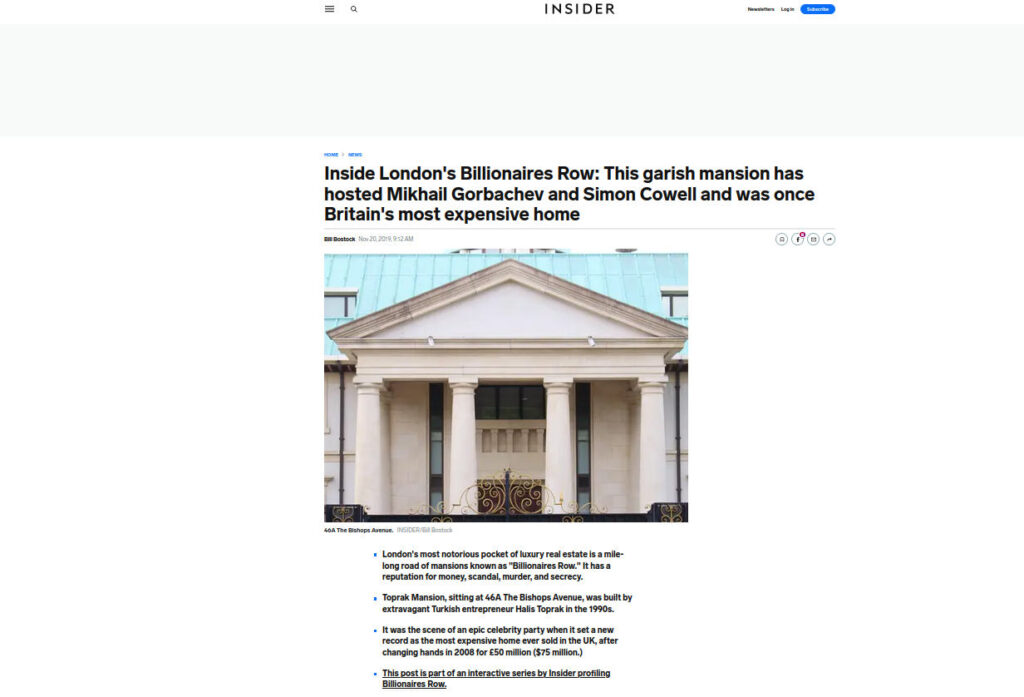

It was a party in “Billionaires’ Row” on Bishop’s Avenue in Hampstead that brought home to me just how mad the world had become.

A mansion had been “sold for £50 million” – allegedly to President Nursultan Nazarbayev of Kazakhstan – then a record hence the celebration. The owner’s beautiful daughters descended to the throng in a glass lift, one in a dress of silk eau de nil, the other in silk vermilion.

All the wheeler dealers in London property were there, and a good assortment of Bishop Avenue’s habitually shy billionaire neighbours. You had to pinch yourself when talking to someone who was pondering whether the glass in their French doors really was bullet-proof or not. It was not a problem I shared, to be frank.

A mountain of caviar was placed on an almost impossibly wide table – quite deliberately, and I appreciated the mordant humour – so that the guests had to throw dignity aside to stretch to the spoils. And they did, too, scooping up great spoonfuls of the stuff – shovelling them haphazardly into their mouths with the black eggs dripping down their chins and splattering the table.

The death scene of Zeffirelli’s Traviata came to mind, where the guests steal the knick-knacks as bankrupt Violetta lay coughing up blood on her bed.

Guest of honour at this event was Mikhail Gorbachev. That’s right, the real one. The man who had presided over the disappearance of the Soviet empire, talking Davos platitudes to assorted millionaires at a party paid for by … a London estate agent.

The financial crash of 2008 put a pause on things, but the Coalition / Conservative governments’ dearest hope was to return to those wonderful days of abundant money (abundant, that is, for those who already had a fair amount of it).

What is the Presidents Club, what happened at the Dorchester charity dinner and who were the hostesses?

THE Presidents Club charity closed in disgrace after revelations some of the 130 hostesses at its annual charity ball were sexually harassed. But what was the Presidents Club Charity dinner, what is alleged to have taken place at The Dorchester Hotel and what has happened since the allegations came to light?

And so the UK property show carried on, and prices still went only upwards – in spite of me calling the top of the market in the Mail every year from 2003.

Now, though, it looks like UK’s luck may finally have run out.

Two decades as international capital’s laundromat – where the hard graft of real wealth creation was being done in hellholes elsewhere – is coming to an end.

Older people, who recall the long years of the 1980 / 1990s crash with resi property falling 40%, may feel that this has a horrible familiarity. Cool Britannia feels a long time ago.

For flat owners, of course, the post-Grenfell fallout has already disrupted lives.

The young and talented are stuck through no fault of their own. They did everything the political party of home ownership, and very likely their parents as well, told them to do. They trusted the UK property industry, and the regulators, and they have been stuffed.

The building safety crisis is set to continue for many more years.

I am sorry for the investor who contacted us, but I don’t think LKP is going to take up that particular cause.

Wyldecrest thwarts attempts by park home activist Tony Turner to provide statement of accounts in upper property tribunal

Wyldecrest thwarts attempts by park home activist Tony Turner to provide statement of accounts in upper property tribunal

Sounds like a re-run of 2008 crash, on steroids. Increasing mortgage costs, energy costs, devaluing sale prices and in some cases remediation.

But in purely in majority foreign owned blocks, Why should the taxpayer pay to remediate these asset seeking overseas buyers?

Another excellent article by Mr. O’Kelly

This older person remembers the 1980 and 1990s quite well, and it was pretty awful. This time around I suspect it will be much, much worse. It seems to me that many Freeholders and their Managing Agents carry a great deal of debt. This debt naturally has to be serviced and with interest rates having risen, and likely to rise even more that debt may well become unsustainable.

The Leasehold industry sector in general derives its income from Ye Old Service Charge, which is obviously paid by the Leaseholders, so in effect the Leaeholder pays for the Freeholders debt. In my humble opinion, if the Freeholders debts increase Ye Old Service charge can only go up, its simply a question of by how much.

I have recently been informed that their has been an increase in the number of apartments who wish to go Right to Manage in a effort to reduce costs, and employ a Managing Agent of their choice. I say to anyone in a Leasehold block provided they meet the legal criteria go for it, you have everything to gain and little to lose especially if you employ a quality Managing Agent.

History does seem to regularly repeat itself, but the lessons learned are not always remembered for long.

Little sympathy here, There’s a difference between owning a home and owning investments. You omitted to mention that overseas buyers were further enticed by the Tier 1 investor scheme whereby we threw in a fast track to indefinite residency… Very handy to those shipping out some dodgy money from their own country. Developers and agents did well out of it but the rest of us have paid not least by the harm done to youngsters (most people compared to me) priced out of the hope of home ownership.

I can empathise with getting a raw deal.

– I don’t know i was born apparently

– Graduated in 2008

– Worked min wage at the start of my career for a decade in a saturated job market

– Spent 2/3 of my income on rent

– By some miracle purchased my first home – a leasehold flat – on a government scheme that kept prices high in hindsight.

– Had a nightmare prostitute neighbour who rented via a pensioner investor that didn’t care about the disruption this business brings.

– Had a painfully incompetent managing agent – but good by other peoples experiences

– Quickly sold it at a loss

– Purchased a knackered old ex council freehold terrace house during a bidding frenzy last summer

– I emptied savings from the one good thing about lockdown (WFH) to facilitate my move and now fuel and energy cost is draining me

– My upcoming mortgage renewal is subject to truss premium

– Pension pot? I doubt much will be left by the time I retire – if that happens before I die.

– Inheritance lol. No that’ll be spent on cruises.

But you know what?! As a millennial, I’m inspired by boomers. The boomer generation raised me. This investor should pull up themselves up by bootstraps, cancel sky (boomer netflix) and get on with it. They did it before and they’ll do it again. One day I hope to extract more from a system than I put in and if anyone challenges me i’ll quote 50degree heat of 2022 and the great freeze of 2022. Tough as nails me.

I can empathise with getting a raw deal.

1. I don’t know i was born apparently

2. Graduated in 2008

3. Worked min wage at the start of my career for a decade in a saturated job market

4. Spent 2/3 of my income on rent

5. By some miracle purchased my first home – a leasehold flat – on a government scheme that 6. kept prices high in hindsight.

7. Had a nightmare prostitute neighbour who rented via a pensioner investor that didn’t care about the disruption this business brings.

8. Had a painfully incompetent managing agent – but good by other peoples experiences

9. Quickly sold it at a loss

10. Purchased a knackered old ex council freehold terrace house during a bidding frenzy last summer

11. I emptied savings from the one good thing about lockdown (WFH) to facilitate my move and now fuel and energy cost is draining me

12. My upcoming mortgage renewal is subject to truss premium

13. Pension pot? I doubt much will be left by the time I retire – if that happens before I die.

14. Inheritance lol. No that’ll be spent on cruises.

But you know what?! As a millennial, I’m inspired by boomers. The boomer generation raised me. This investor should pull up themselves up by bootstraps, cancel sky (boomer netflix) and get on with it. They did it before and they’ll do it again. One day I hope to extract more from a system than I put in and if anyone challenges me i’ll quote 50degree heat of 2022 and the great freeze of 2022. Tough as nails me.

Dreading service charges next June. Even though get none of the services I pay for , £1000 for cleaning that doesnt happen because socket broken for last 8 years. Not making this up. Fix the socket? ha took them 8 years to fix the entrance door.

but those crooks at y&y management will probably raise the service charges 20+ % blaming inflation.

Unfortunately no point suing as this will cost me more even if I win and the lease allows them to claim costs anyway. Not to mention will scare of any sucker I can persuade to buy flat.

Ps I know y&y like to threaten suing for libel on sites where people complain about them, so if u are reading y&y, go on I dare you. I have evidence of you ripping off me and the other leaseholders.