(And what will new chairman Roger Southam do about it?)

The Leasehold Advisory Service is recruiting two new legal advisers this month, with special emphasis on developing the quango’s commercial activities.

The posts are for a senior legal advisor, a barrister or a solicitor, and a legal advisor, who will also require a legal qualification.

But the news release here adds: “LEASE is developing a growing commercial offering and experience of developing the delivering relevant products will be an asset.”

LKP has expressed concerns about the corrosive nature of the quango’s commercial enthusiasms, which are more likely to serve the interests of the leasehold sector, and professionals in it, rather than home-owning leaseholders.

The Leasehold Advisory Service required constant prodding over eight months to dump the advertising in July last year of property manager Benjamin Mire, of Trust Property Management. Trust is now up for sale.

But of particular interest to the new chairman of LEASE, Roger Southam, will be what we regard as the nadir of LEASE’s commercial activities.

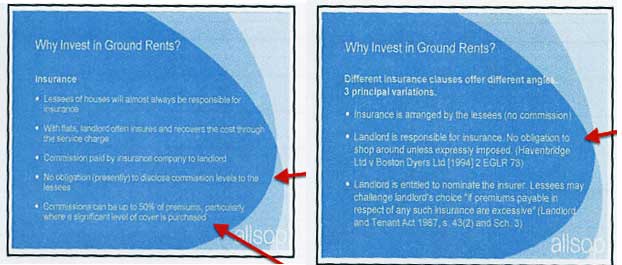

These were witnessed at the 2010 annual conference when Gary Murphy, the vice-chair of the RICS auctioneering group, gave a presentation titled “Why Invest in Ground Rents?”

He demonstrated how freeholders of a site could help themselves to up to 50 per cent of the total insurance premiums in commission, and – best of all – leaseholders would have no legal right to know the level of payments.

This is because they are not the customer with the insurance company, the freeholder is. Leaseholders simply pay the bills.

Mr Murphy’s very helpful presentation slides are reproduced here. They include the additional detail that there is “no obligation among freeholders to shop around”.

Mr Murphy’s very helpful presentation slides are reproduced here. They include the additional detail that there is “no obligation among freeholders to shop around”.

Insurance commissions are one of the most blatant abuses in leasehold, which have been repeatedly criticised at Leasehold Valuation Tribunals.

Should this presentation have been made at an event organised by a taxpayer-funded body?

It is a particularly relevant question to put to Mr Southam, the founder of property management company Chainbow, as he was a speaker at that year’s annual conference.

Also, he had exposed rip-off insurance commissions in 2007, according to the Evening Standard.

When the freehold of Boardwalk Place, in east London’s E14, which his company was managing, was sold to Vincent Tchenguiz in September 2005 insurance demands came to more than £100,000.

“I went to a broker and got a quotation for £60,000, including a 20 per cent commission for the agent or freeholder,” Mr Southam was quoted as saying.

He felt sufficiently strongly on the subject to add on his blog:

“We have also hit the headlines with the Evening Standard on the topic of insurance commissions and transparency.

“This is an area where the Royal Institution of Chartered Surveyors (RICS) pledged to investigate this issue but have done nothing to date.

“So the Chainbow Crusaders will keep plugging away on this as well, while the freeholders and agents maintain their cloak and dagger existence … ”

All this is music to our ears at LKP. But how are Mr Southam’s public views of this sort going to square with LEASE?

Specifically, how can LEASE engage in commercial activities in a rather squalid sector such a residential leasehold and not become tainted?

There are plenty of other quangos that do not feel this obligation to engage in money-making initiatives, and for very good reasons. An example is the Intellectual Property Office.

In fairness to LEASE, politicians at the DCLG have been pushing the quango to engage in some money-making to mitigate costs (even though public entities unfailingly fail at this sort of thing).

But it is also plain wrong. LKP has provided an abundance of evidence that things are none too savoury in residential leasehold. So have the courts, and the CMA.

Obliging the supposedly impartial consumers’ quango to swim in these shark-infested waters is self-evidently not a good idea.

If LEASE cannot survive without toadying up to commercial interests – as has been argued – then private sector methods of providing advice would be preferable.

We have already seen examples of this with ALEP, the Association of Leasehold Enfranchisement Practitioners. It provides advice on lease extensions directly to consumers (with half an eye to getting the business, obviously).

Response from Roger Southam

Thank you Sebastian and I am happy for you to reproduce the whole of this response, please do not cherry pick quotes from parts of sentences.

As I have been in post all of 5 days it seems a tad precipitous to think I can be the saviour of the leasehold market and the transparency issues you have been lobbying on, although if I could I suspect I would quickly be summoned into the Foreign Office for my next assignment.

Life has moved on a long way from 2010 to now and the article you present seems to mix up a number of different areas, attributes, impacts and effects. The challenge for any Government department or quango is how to achieve the maximum impact and effect for the minimum of expenditure. There is nothing wrong with commercial ventures as long as the core ethos is enhanced and maintained.

It is interesting you approve of ALEP when clearly their members desire is to be engaged and appointed – hardly unbiased? Yet you say that is okay but for LEASE there should be no commercial activity? Always such commercial activity would be without any favour or toadying as you state, LEASE will always remain impartial and a free service to leaseholders.

You want commercial companies to give impartial advise? And why would they want nothing when you seem to say LEASE does? Surely the other way round.

If your supporters in Parliament are happy to assist and lobby to get the funding needed for LEASE without commercial activity then we would be delighted to receive it and run as an advisory body without any commercial activities. Being realistic however that is sadly not going to happen.

I am still as much opposed to excessive insurance commission as ever I was and it should be acknowledged how much the market has changed. There will always be a small minority who want to push boundaries but on the whole it is getting better as the CMA acknowledged in their latest report. We should not lose sight of the bulk of the market and the work being undertaken.

Obviously we have an interesting ride ahead and if we can agree one thing at the start of my tenure, it is fine to reference history but please do not try to imply nothing has changed. The residential leasehold world has changed and continues to change for the better, but there is more to do. There will always be some wanting even more but everything takes time to the frustration of all concerned.

Kind regards

Roger

LKP urges minister to include leaseholders in Flood Re insurance plan

LKP urges minister to include leaseholders in Flood Re insurance plan

LKP/Campaign against retirement leasehold exploitation is very pleased to see the change of Chair at LEASE and we look forward to meeting Roger in the near future -although he will have to go some way to argue things have changed at all since 2010.

Of course now Roger has gone “official” he has to argue the case for LEASE becoming more “commercial” or having more funds. Lets see what the Triennial review of LEASE concludes first?

Mr Southam

If LEASE has to operate with a ‘commercial element’ to generate revenue to survive, then why not set up an in-house Right To Manage facility with set fees until we can get rid of leasehold tenure for good?

With the expertise and knowledge of the people working within LEASE, I would imagine that would be an easy task to do as LEASE staff should know the law inside out. on this subject.

A nominal fee could be asked per leaseholder as happens now with the private sector, but the difference would be that once RTM had been achieved then leaseholders would be free to choose which ever managing agent they prefer and not be held hostage the to ones that had helped them achieve RTM status for up to 4 years as can happen now.on some sites.

That would have to be a win win situation for LEASE surely? Or, are LEASE still hell bend on keeping the lawyers (mainly in London) in a lifestyle that they have become accustomed to at the expense of poor ( ignorant of leasehold law) leaseholders.!

Forgot to tag on at the bottom.

Our managing agents (appointed by we, the RTM Co) shopped about for a good deal on our buildings insurance this year.

Unfortunately, they didn’t shop about enough because I managed to get a quote £4,000 cheaper…..guess who won!

Roger Southam,

What you could do is offer associate membership of Lease to all leaseholders for a one off fee of £25. For that the leaseholder would have access to free advice, possibly even a minor dispute conciliation service. This would give Lease a secure form of income, meaning they would be less dependent on income derived from some of the biggest villains in the leasehold sector.

That leasehold has changed since 2010 is true to an extent. How much change would have occurred without About Peverel, Campaign against retirement leasehold exploitation and LKP is open to question?

To be successful, Lease cannot remain in the domain of the vested.interests that have brought leasehold into total disrepute(and was demonstrated by the threats made against Campaign against retirement leasehold exploitation/LKP, Cirrus sponsoring a Lease event and the Benjamin Mire scandal) has undermined the credibility

of Lease..

Mr Southam,long suffering Leaseholders have had the talk. Let’s have the action.

Thank you for the comments and replies and the time taken to address is appreciated. One thing I must correct is that LEASE is in no ones pocket and never will be. I need all to see that I am a new Chair of LEASE and to be judged from 1st January 2015. I cannot change the past, I cannot change perceptions easily but what we will do is make sure there continues a free advisory service to leaseholders. It is impossible to please all the people all the time but what we will do is be available and accessible and transparent in our dealings.

Kind regards

Roger

Roger,

You do not need to correct that “LEASE is in no one’s pocket” as that has never been said or suggested.

It has wrongly, in our opinion, hosted inappropriate presentations for the benefit of those seeking to profit in the sector; it has accepted, and decided to decline, advertising from dubious practitioners. That is not disputed.

LKP

Allsop left something out of course the insurance has to be fair and reasonable under section 19 and as numerous LVT/FTT decisions show, a landlord is at risk if the overall premium and or cover can be shown to be wanting.

That doesn’t mean cheapest of course and larger commissions can be justified if they represent costs and activities under that portfolio that are justifiably undertaken.

AM your right although proving insurance costs unreasonable is not an easy task.

There were of course many things Allsop missed from his talk and perhaps would not even know about. The dirtiest bit being the insurance sectors willingness to “off shore” certain payments in bigger policies -not an issue specific to leasehold by any means. Then there are the soft and contingent commissions as well as some of the tricks explained by another insurance broker at the 2012 conference who talked about the small holes in some policies which cut down on the risk to reduce cost or allow larger commissions -in that instance the broker was advocating better cover – hopefully.

Of course you are right Martin, but let us not forget how in the case of a well known property management company (I will not name them in case i upset anyone from Luton or New Milton) had the method of calculating commissions changed to one that depended on the amount of insurance claims made. After the change it was felt that the number of claims were reduced. It has been suggested that what previously would have been a routine insurance claim, instead were being diverted to the service charges, at the behest of property managers “encouraged” to reduce any claims . There have even been suggestions that when an insurance claim is unavoidable, each part of the claim is separated in order to fall within the policy excess. For example if a toilet leaked causing damage to a carpet , the claim would be for a replacement toilet and another claim for the carpet. Thus both claims are under the excess.

It also should be noted that some within the company (i Won’t mention!) believe that some insurance claims can be made on a verbal basis alone without any paperwork.

Michael you’re right claims history is key driver on the premium rate. On this one I would assume incompetence rather than a devious Peverel person working out if the premiums were higher through a bad claims history..

It has takes 5 years to clear out a poor claims history -and ours was a real mess. Those in Luton will be very pleased to learn at Charter Quay we pay a lot less for our insurance now than we did 5 years ago but somehow our insurance covers a few more things than it used to do!.

Michael,

How right you are, when the WC leaked in the House Managers Flat the Area Manager first stated in writing that we could not claim.

When challenged he changed his mind but stated that we had to make two separate claims, but each claim was covered by a £500 excess.

I later found out that all the correspondence was carried out verbally as the Area Manger can spend up to £699.99 before they are legally forced to inform us?

Thank you for reminding me.

Michael the figure should have been £7,000.00 not £699.99 as I posted regarding the figure at our development as 28 times £250.00 is £7,000.00, sorry for any confusion.

The information I have received over the past 5 years explains why there are no Paper Trails/Contract Documents/Reports/Confirmation Letters or any written trace of works undertaken by our Area Manager since 2005/06.

The lack of professional management had been due to the total number of developments each Area Manager was expected to manage.

Our Regional Manager was promoted in 2007 3 months before our Warden Call System was due to be replaced, and would have been aware that the loosing tenderer was sub-contracted to undertake the works.

Instead of working to benefit us pensioners, the Area Managers WERE ALLOWED TO CUT CORNERS by Regional Managers.

The Area/Regional Managers were aware of this practice and continued until 2009 when they were outed by the press for Lying and Cheating us pensioners.

Cirrus Communications would at each development where the SYSTEMS were reaching 20 years old, (ripe for plucking) would verbally informing that all Warden Call/Fire Systems were OBSOLETE, thereby ensuring as they did, 5 years continues works, worth £1.4 Million.

After being caught out cheating, Peverel Group gave the 65 cheated developments £1,538.00 each.

OFT smacked Cirrus/Peverel wrists and allowed them to keep some £500,000 of moneys CHEATED FROM PENSIONERS.

What did David Cameron do when he learned about the way Peverel behaved in London, he intervened himself, so he is aware of what has happened, has he been seen to do anything?

I can understand that Roger drew the inference that a free advisory service that provides considerable training to the freeholders and professionals ( and wide boys, girls and I guess TGs) of the sector whose interests do not automatically align with flat owners, has to serve two (often, not always ) contradictory purposes.

That the latter provide a chunk of LEASE’s operating budget, it is perhaps then for LEASE to not simply assure that they are not in any ones pocket, but demonstrate how they feel that this is not a valid issue, how they manage it or provides photos of the Chinese wall.

Thank you to Karen for continuing to express her very serious points mostly the issues around Building Insurance, Thank you to Michael Epstein for highlighting importance outcome , in my opinion , related to failure of Lease and colluding with some management agencies including Mr Mire.. I am still waiting to hear from JACO regarding my Complaint.

In my opinion free advise is not our major need. Some leaseholders has been and still are under immense pressure from their freeholder, and the impact is extended and very painful. Leaseholders need control on their home and their finance.Their home should not be for profit making and be targeted by Insurance companies and Management Agencies.

We hope Roger can tackle the seriousness and bring some fairness for leaseholders.

As I have pointed out many times: Why do LEASE have to provide a service to a commercial element within leasehold?

LEASE was after all set up by the Government as a key advisory service to help ‘primarily’ the poor disenfranchised leaseholder who had nowhere else to turn, but.It now seems this service has been hijacked by the commercial world.

If these companies have such huge problems with their businesses then they should be paying a huge premium for commercial advice and not sponging off the state.

They have no problem appointing expensive barristers for help when they are trying to repossess someones home and there is money in it for them!!!

LEASE can never be impartial in my view whilst they are acting a for both sides!!!

You may as well argue that because LEASE explains notices for ground rents, how to do Section 20 and summaries of rights, etc that it is “cluing up” a freeholder and therefore against the interest of leaseholders.

It is therefore a rather simplistic view to say that they are serving two masters. Lease provides advice from its staff and publications to flat owners and building owners. Many building owners are unaware of their obligations and the information is of use to them.

The big boys don’t need to go to LEASE for advice but paying for the seminars that they run, using their brand, and which are open to all, help fund that advice service. Unless you can show information is being withheld, then its the equivalent of screaming burn the witch, its baseless suspicion. After all the level of advice falls far short of the complexity of the training courses as they have distinct different purposes, and LEASE are not in the business of detailed legal advice and case preparation.

If the argument holds true that if LEASE sell courses to the sector its good for the sector and helps subsidies the free service to the public it also holds true trading standards could run some very useful courses to some of a few market traders and builders . The advertising standards authority could run courses in how to get your advert within the rule book – just. Maybe OFCOM could offer a bit of training to Mr Murdock

Our argument is it would be far better if LEASE did not sell courses as they almost exclusively benefit the sector rather than leaseholders. Why does LEASE even need to be in this market when there are plenty of private providers. A nationalised training service for the private sector is that what Housing Minister Brandon Lewis is supporting??

You however put your finger on the nail when you say the paid courses offer more complexity for different purposes. That purpose sometimes being for the managing agent to put themselves in a better position to face a challenge from leaseholders. LEASE has a rule it can not provide detailed legal advice or help in case preparation on a single case but they do sell courses that help agents learn about the principles which might apply in any case.

I think if you do the maths you will see LEASE as an organisation would be far more financially viable if they offered their services for seminars on leasehold issues, at a cost that was acceptable to the majority of leaseholders and not just to the big commercial outfits for swanky black tie dinners!

I haven’t seen one seminar from them offered in the North of England yet! so that is absolutely no excuse.

I know many people who would pay to attend LEASE seminars to be able to ask pertinent questions given the chance.

It is high time that LEASE as an organisation ventured out into the big bad world of leasehold and saw for themselves what is happening on a lot of sites.

It may suit LEASE not to attract attention to their organisation but thankfully LKP can carry on doing that for them.

I agree Karen,

I for one would love to attend a seminar FOR leaseholders (not the patronizing evening hour or so offered by LEASE at the end of the DAY for freeholders/ managing agents and associates!) but getting to London would also make things more difficult so maybe they could have smaller ones around the country?