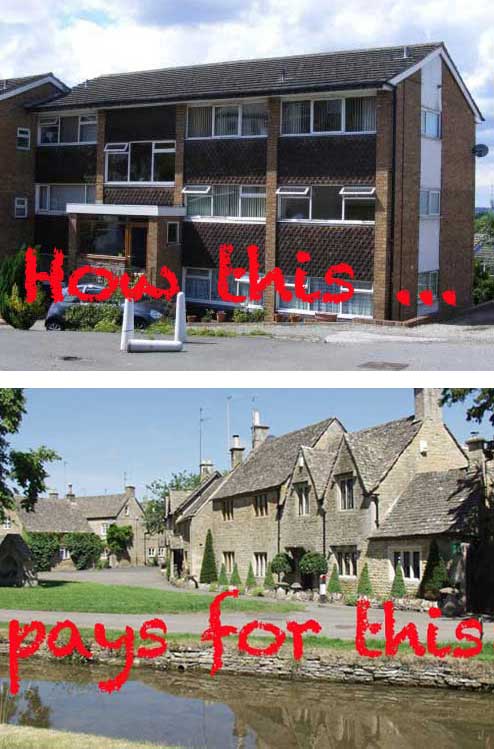

An affluent couple living in the idyllic Cotswold village of Lower Slaughter are funding their lives through leasehold property cleverness that is costing poorer property buyers thousands of pounds.

An affluent couple living in the idyllic Cotswold village of Lower Slaughter are funding their lives through leasehold property cleverness that is costing poorer property buyers thousands of pounds.

Martin Paine and his wife Margaret Anne Kirmond are benefiting from the sale of flats at Blythe Court in Coleshill, Birmingham, which have a trap in the lease that ends up costing homeowners thousands a year.

The lease terms are so unobvious that so far four – and possibly seven – firms of solicitors acting for buyers have failed to spot them.

Kadian Kennelly, 32, a social worker and first-time buyer, paid £58,000 for 7 Blythe Court flat on October 7 last year and was told by her solicitors that the ground rents would be £250 a year.

She was horrified later to be presented by Martin Paine with a demand for a ground rent of £8,000 a year.

The ground rent increments, which double every ten years, are so designed that in 90 years time they will amount to more than £4 million a year.

“I feel absolutely devastated by this,” says Kadian. “I sank my savings into this flat and borrowed off a friend to buy it, although I now have a mortgage.

“This is just blatant exploitation of obscure legal rules to prey upon the naïve, the poor or the very poorly advised.”

Martin Paine, who is not a lawyer, presented the ground rent demand as “head of legal services” of Circle Residential Management Limited on behalf of the freehold-owning company Mercia Investment Properties Limited. What he does not tell residents is that both companies are ultimately owned by him or his wife Margaret Anne Kirmond.

“My solicitor did not spot what is a deliberate trap in the lease,” says Kadian. “This means Martin Paine and his wife are now in the position to extract this money from me, or force me to sell and take a chunk of the proceeds.

“Put frankly, their behaviour is repugnant.”

Kadian has fallen victim to perhaps the worse scam in leasehold, explained in detail here

On February 9 2011 solicitors acting for a previous owner, who had died, agreed to a deed of variation to extend the lease by 99 years added to the 50 years already existing. So, 149 in total.

In fact, hidden in the document is a clause that means that this extension does not start from 2011 – as all these solicitors have assumed – but from 1961, when Blythe Court was built. The lease variation also doubles ground rent every ten years from an initial £250.

As a result, Kadian faces the demand that has risen to £8,000 a year.

It would be possible to challenge the deed of variation in court, and there are grounds to do so even with the wording of the deed of variation as it stands, according to a barrister who has studied the documents. But that could cost the families at Blythe Court thousands of pounds.

Kadian is far from being the first victim-owner at 7 Blythe Court.

The first purchaser of the flat after the deed of variation was Michael Herring, a buy-to-let investor who paid £85,000 in February 2011, of which £24,000 was cash.

“It was a nightmare for more than three years that cost everyone involved a lot of time, effort and money,” says Herring.

He sorted the problem out by taking a professional negligence action against his conveyancing solicitors, whose insurers paid up.

“It cost the insurers £109,000 to sort everything, which is a staggering amount of money. I got £30,000 back,” says Herring. “I was so glad to see the back of the place.”

As part of the deal the flat was sold to Martin Paine’s company Kirmond PP Investments Limited (of which he owns 100 per cent) for £30,000.

On February 12 2015 Kirmond transferred the ownership of the flat – for a declared £70,000 – to F.t.z. Limited, which is 100 per cent owned by Mrs Paine (Margaret Anne Kirmond).

On April 30 2015, 7 Blythe Court sold at auction for £72,000 to Julian Carter.

Carter evidently decided to get out quick after receiving the £8,000 a year ground rent demand, and the flat went to auction again in July, but did not sell.

In September, it was set to be auctioned again when Kadian purchased the flat for £58,000.

In October, Martin Paine demanded his £8,000 ground rent dating back to March 2015: in other words, for nearly two months when the flat was actually owned by the Paines’ own companies.

Kadian and her solicitors had agreed to pay outstanding ground rent when she purchased the flat, believing this to be no more than £250.

“All I was trying to do was to buy a flat so that I could commute to work,” says Kadian. “I have fallen into a deliberate trap set by Martin Paine to catch the unwary and their solicitors.”

£58,000 is a bargain price that may have alerted some buyers, but then recorded prices at Blythe Court vary from £30,000 to £105,000.

Kadian used solicitors John W Dawes of Newport, who could not jettison her fast enough when the scale of the disaster unfolded.

Having informed Kadian in writing that her total ground rent would be £250 a year for the flat and £10 for a garage that she had also bought, John W Davies could not make it clearer that the £8,000 a year ground rent that subsequently emerged was her problem alone.

On December 2 the solicitors told her that they had received the demand for £8,000 and she had agreed to pay outstanding ground rent and service charges from March 2015.

“Accordingly, please arrange to contact Circle Residential Management Limited directly to make payment to settle this demand,” wrote Michael Jenkinson for John W Dawes in his last communication to his client.

Martin Paine bought the freehold to Blythe Court on September 15 2004.

At first he seems to have behaved like most other freeholders, extending the leases of two flats by 99 years the date of the application.

As a result, the flat at 2 Blythe Court was extended on January 28 2005 for 99 years from a start date of 25.3.2005; flat 6 Blythe Court was extended on February 4 2005 for 99 years with a start date of 25.3.2004.

Thereafter the cleverness began.

In total, six other flats in the block are in the same position as Kadian. All have lease extensions for 144 or 149 years and ALL are dated back to 1961. (The numbers differ depending on the date of the extension application in order to add up to a 99-year extension to the lease.)

Chris, a landscape gardener, and Sarah Cherry (left), an admin supervisor, bought the flat 11 Blythe Court for £105,000 in 2007, when they were 25 and 19 years old. They put down £5,000 in cash.

Advised by solicitors, they extended their lease with Martin Paine. But rather than extend the lease by 99 years from the date of application as they thought, the lease was increased to 144 years dating from 1961.

“We brought the flat in 2007 and renewed the lease to start from that date,” Sarah explains. “Me and Chris were both on minimum wage when we purchased this our first property together.

“We literally scraped all the money together that we could to do this as we wanted to stand on our own two feet.

“Martin Paine started the ground rent demand from 1961 at £250 doubling every 25 years.”

At first, the couple were paying £500 a year in ground rent, but it doubled in 2011 to £1,000 as another 25-year stretch began.

On top of the ground rent, the couple, who now have a three-year-old daughter Aimee, have to pay the service charges as well and contributions to insure the building, as do all the leaseholders.

Ground rents of £1,000 would typically be seen in areas such as Knightsbridge or Chelsea, rather than Colehill, Birmingham.

“We feel that we have been utterly conned.”

The couple almost certainly had a valid claim against local solicitors Waters & Co, who advised them. The firm was well aware that there were issues with the leases at Blythe Court, writing to Paine on September 3 2007:

“May we respectfully remind you to check the calculation of the ground rent in the lease. We had dealings with a property recently in the same development where an error was made in this regard and the lease in its new form would have been completely unworkable insofar as payment of the ground rent is concerned.”

The Cherrys did, in fact, take the matter to the Legal Services Ombudsman, and were repaid Waters & Co’s conveyancing fees of £707.94.

Unaccountably, they then did not proceed further with a claim against the solicitors in the courts.

In January this year, the Cherrys again protested about the £1,000 ground rent to Martin Paine, which they were having difficulty paying.

On January 6 Paine emailed saying that “The freeholder [that is, Mrs Paine] is willing to look at a revised rent review mechanism for your lease.”

But he made clear that the landlord would need compensating for loss of income and he urged the Cherrys to take legal action against their solicitors Waters & Co using a no-win no-fee solicitor found on the internet.

But, Mr Paine, was sensitive to the issue of a six-year limitation period on professional negligence claims.

“… however, I can see that it is also arguable that your “sufficient level of knowledge” occurred after the last rent review date in 2011 when the first £1,000 rental payment fell due … I think it is vital that you immediately seek legal advice (some firms offer a no win no fee negligence claim service, try a google search).

“I also think that the date of any admission made by Waters & Co will be critical in deciding on the commencement date of the limitation period.”

Young Polish couple Patrick Majszyk, 32, and Wieslawa [Vanessa] Chudzik, 30, paid £100,000 for flat 3 Blythe Court on December 20 2013, borrowing £85,000. Both are employed working in a warehouse.

They had previously been tenants in the property.

Here the lease was extended to 150 years on November 7 2012, back dated to 1961. Ground rents are £350 a year doubling every 15 years, so Patrick and Wieslawa now receive demands from Paine for £2,800 a year.

They are paying this off with £75 a month instalments, increasing to £100 in six months’ time.

“We are from Poland and we had no idea that you could buy a flat with these sorts of problems,” says Patrick. “We have put all our money into this flat and now we learn it is unsellable and almost worthless.”

Patrick and Wieslawa contacted their solicitors Birchall Blackburn Law, who had carried out the conveyancing when they bought the flat.

The firm wrote a detailed letter to Paine in May 18 2015, hoping to sort out what they imagined was a simple lease extension error.

Five months later on September 2, DF Legal replied on behalf of the Paines’ company Mercia, rejecting the arguments and explaining that backdated rent had been upheld in the case Bradshaw v Pawley 1979.

On September 18 Birchall Blackburn Law told Patrick and Wieslawa that it could not act for them as “we consider there is a conflict of interest”.

Having carried out the conveyancing, the solicitors are aware that Patrick and Wieslawa will almost certainly seek redress from them.

Sir Peter Bottomley MP, who campaigns for justice for leasehold flat owners, says that Blythe Court is a scandal.

“I am shocked by this unjustifiable attempt to devalue a home and to extract a fortune.

“It is illegal to stop someone on the highway and to take the contents of their wallet.

“It should be illegal to impose unfair leasehold terms that have the same effect.

“The law and the courts should give protection, retrospectively when necessary.

“Unfair terms need to be condemned and declared unenforceable.”

Last month, LKP contacted Mr Paine about concerns regarding Blythe Court on December 17 and December 25.

In addition, a draft version of this article was send to him, and received, on Monday January 18.

He claims that the article is inaccurate, but has declined to provide details.

He has acknowledged that he is not a member of the Housing Law Practitioners’ Association, as was stated on the Circle Residential Management website.

Paine’s website also has the undertaking in its code of practice: “To deal with Tenants both in the spirit of the legal requirements as well as in the letter of the law.”

He has been contacted for a statement prior to the publication of this article.

Telegraph reports that leasehold newbuild flats are on the rise

Telegraph reports that leasehold newbuild flats are on the rise

Before I start my speech, I’m sorry for my English.It is not perfect but it’s enough to say what he feel. I agree with Kardian That means a lot to us and the comments today have been truly amazing. . We know that we are not alone on this. There are many so many things I would like to change in this flat, but its been two years and I can not do anything about it because I do not know if ‘ll be still here tomorrow . I met the owner of flat no 1. He put all his savings in to the flat (before was a total mess here) now is one of the places where you can just enter by bringing your belongings, but he had to sell the flat as soon as ahe recived a bill for 8k pounds. When I got the bill at 2,800 pounds, I thought( like everybody else ) that this is a mistake. For Two years I asked my lawyers who helped me in buying the flat for help . Two years I have asked my lawyers to help me to solve this problem. At the end I received a message that they can not help me, and I was left alone. Thanks to Kardain, thing started, and within two days was said and done more than in two years thanks to my lawyers. I thank God that he put right people on our way to sow us we are not alone , and if this metter can help people who is having same proplem as we have it’s going to be great 🙂

We are all in this together and thanks to LKP and their many patrons we are not alone. All of your comments and support today have been overwhelming and tonight I feel a real sense of change.

So from my heart to all the many posters thank you. Thanks for taking the time to share your views and for joining in our fight.

Is it possible that we have reached leasehold’s Milly Dowler moment?

Leasehold injustices affect a lot more people than were ever affected by phone hacking. It’s a disgrace that it has not received the attention it deserves. The reason is obvious enough. The Conservative Party is on the take from wealthy freeholders (people like Vincent Tchenguiz). The corruption goes all the way to the top. Former chancellor of the exchequer Norman Lamont has been on £1,000/day consultancies (for “advice”) to the Tchenguiz group, which has donated six figure sums to the Tories. David Cameron’s brother in law is a monetising freeholder.

The lives of millions of people are blighted by this corrupted, antiquated institution. It has been abolished everywhere that inherited it from English common law, except in England and Wales.

Australia, America, South Africa, Hong Kong, Scotland, Ireland. Canada etc. GONE.

The hypocrisy of the Conservatives pretending to be the party of aspiring home owners is breathtaking. This is the party, let’s not forget, of duck houses and moats. They need to remember

“Those who make peaceful revolution impossible will make violent revolution inevitable.”

–John F Kennedy

Could it be that apart from political donations (to any party) one key reason for stopping leasehold reform is the exposure of banks to loans granted to freeholder/connected managing agents? After all, was it not the Tchenguiz family trust portfolio, that not only was overvalued, but was securitised against a 150 year income stream?

Suppose for a moment the true value of freehold portfolios if sold to leaseholders was 40% of the funds borrowed? What effect would that have on the lending institutions?

Rumour in the city suggests that one high profile bank may be exposed to upwards of 63billions of property related loans.?

By holding off on leasehold reform, debts can be kept of the balance sheet. Very useful if you are a government that wants to sell off a bank!

Simply disgraceful!!!!! They should be ashamed of themselves and their greed…I sympathised with the flat owners, hopefully you guys will get some justice!

It should always be remembered that long leasehold tenure was created by freeholders for freeholders.There are 4 main areas of a lease that allow for profit to be made: those of buildings insurance, ground rent ( as in this story), lease extensions and various consents that have to be obtained from the freeholder.

The conveyancing solicitors acting for the buyers should have spotted the ground rent provisions even if the lease was of considerable length as the reliance of them to get things right is a heavy one. They all have to be read through fully to spot such things, particulary those written before 2006 which are usually written in legalise (with no punctuation) and may be as many as 50 pages in length!

I’m not sure it is does a lot of good imploring those that utilise the profit making elements of a lease to its full advantage to ‘do the right thing’ because in their eyes, they have done so, by operating within the terms of what the lease allows them to do.

There will be undoubtedly be more stories of this type, despite the continued efforts to ensure that prospective leaseholders get as much information during the conveyancing process as possible. It must be understood that the long lease (bottom line) is a money making document for freeholders and it is vitally important that the type of freeholder a block of flats has is never overlooked.

Sharon

You say that it is not worth imploring those who are profiting from this situation to do the right thing.. Because they are operating within the terms of the lease. More likely reason is they will not care.about the harm they do.

Will it not be a similar type of people who with some devious solicitors, drew up this odious lease in the first place.

They must know full well that their lives of luxury are being funded by leaseholders who are having their lives ruined.

They should receive a long ban from operating in the Leasehold industry, as they would be in many other professions, if they caused harm to society like this.

.

Just checking the type (reputation) of freeholder is no guarantee of ethical behaviour in the long term. There has been a well established pattern of behaviour in the industry of transferring freeholds to associated companies done in such a way and for the sole purpose of denying leaseholders right of first refusal to acquire the freehold.

The leaseholder is powerless to prevent a freeholder selling out to a diabolical monetising landlord — the kind who pay over the odds for freeholds because they have a well developed repertoire of creative ways of getting their money back and earning above normal returns with little risk to their capital.

Very well put Paul Joseph. This has been my experience also. Leasehold needs strict regulation/ radical reform, rather than leaving it, to the freeholders philanthropic tendencies.

This case is reminiscent of the Peter Rachman scandal in the 1950/60s, that became known as Rachmanism … [REDACTED]

Wholeheartedly agree with you. Criminal legislation for white collar fraud and change.org for leasehold reform. The difficulty is coming up with sufficiently sweeping reform to actually make a difference. For reporting solicitors there is the SRA, though not sure if they actually ever do anything.

Looking at the Land Registry’s register of title to flat 7 it is curious that the Property Register, showing short particulars of the property and of the lease, is silent as to the Rent. Such titles would usually read something like, “Rent: as therein mentioned”, not as in this particular title, “Rent : — “.

Relief for Kadian must begin with a claim against her former solicitors. Her mortgagees’ valuation report would probably have been qualified on the assumption that the lease did not contain unusual or onerous provisions. Kadian might suggest to her mortgagee that the valuer should be asked to re-value the flat after reading the lease and understanding the ground rent terms.

The mortgagee should take an interest when it is realised that its security is not worth what was previously believed and its solicitors (perhaps the same solicitors acted for Kadian and her mortgagee) will be required to explain how they were able to certify that a good and marketable title was being acquired.

Yes, it is a mess but there is hope and Kadian is assured of sound advice and support from LKP, its patrons and admirers. There must be specialist solicitors taking an interest and ready to act on a conditional fee basis?

Sharon Crossland in her comment above states: “..it is vitally important that the type of freeholder a block of flats has is never overlooked.”

And this is a central point. There are good freeholders and there are bad freeholders. Milking vulnerable leaseholders has become a game for the baddies out there, and Ground Rents, Informal Lease Extensions, and Buildings Insurance, along with a host pf dodgy “fees” for various, are the tools of the trade for this unscrupulous bunch.

And so long as they remain unregulated they will continue without let or hindrance.

These people are utterly ruthless in pursuit of their ill-gotten gains and, aided and abetted by unprincipled legal advisers, they customarily ignore bad publicity and continue unabated..

Only proper regulation of the leasehold sector will root these practices out.

Paul J, Stuart R and Leaseholder,

I could not find any articles in Saturdays press so I did not do my paper round

If you do want to contact me Sebastian O’K has my e mail

Mr Martin Paine, of Circle Residential Management, Chapel Court (Tewkesbury) Management, Mercia Investment Properties Limited, Kirmond PP Investments, Malvern Court Management … and many others undoubtedly.

A reoccurring pain at the Leasehold Valuation Tribunal. It’s a wonder he has not been allocated his own parking space.

This is what Martin Paine does. Extortionate charges through any method available to him.

In one Tribunal case, Circle Residential Management (aka Mr Martin Paine) representing Mercia Investment Properties (aka Mr Martin Paine again), failed to justify to the Tribunal why he wanted a leaseholder to pay £4,000 to grant consent for an extension. This was after charging the leaseholder £115 for administrative consent, wanted an additional £4k. The tribunal said no and Mr Martin Paine was sent on his way.

If any one of Mr Paine’s property management companies manages your leasehold flat, you can be sure to expect extortionate service charges.

What has happened here is most unfortunate, but sadly not surprising giving the individual involved.

Well done to LKP for this exposure. It has been a long time coming.

Let’s give Mr Martin Paine the much needed exposure and reviews he truly deserves. Let’s ensure that this story remains in a prominent place under Google Search.

Everyone commenting on this article, please state his full name (Martin Paine) when making reference to him and do so as many times as possible, so that Google continues to pick it up. Also, please use the word ‘review’ wherever possible. Keep Martin Paine on the front page.

Resident’s featured in this article and all others reading this article who have been personally been affected by Martin Paine, send your story to BBC Watchdog.

https://ssl.bbc.co.uk/programmes/b006mg74/contact

For those not personally affected, but feel the great injustice, please contact Watchdog and urge them to investigate Mr Martin Paine. Their email is watchdog@bbc.co.uk. You can forward them the link to this story to read. Let’s apply the pressure.

Everyone, both the affected and unaffected, please email Daily Mail. Those directly affected, tell them your story, those unaffected, again forward the link and urge them to investigate. Their email is news@mailonline.co.uk

I have already done so. Please join me.

Information obtained from “companycheck” figures as of today

All of the companies are registered at the same address in

Leckhampton, Gloucestershire.

Circle Residential Management Ltd. Comp No 05131646

Owned by Martin Paine & Margaret Anne Kirmond

Dirctr Martin Paine. Secretary Ms Margret Anne Kilmond

Net Worth £1.2K

F.t.z Ltd. Comp No 04010802

Owned by Margret Ann Kirmond (aka Mrs Margaret Anne Paine)

Dirctr Martin Paine. Secretary Martin Paine

Net worth £1.1M

Mercia Investment Properties Ltd. Comp No 03287391

Owned by F.t.z Ltd. (Martin Paine’s wife)

Dirctrs F.t.z Ltd & Martin Paine

Secretary Ms Margaret Ann Kilmond (aka Mrs Margaret Anne Paine)

Net Worth £2.1M

Meryon Properties Ltd. Comp No 06805418

Owned by F.t.z Ltd. (Martin Paine’s wife)

Dirctrs F.t.z Ltd & Martin Paine

Net worth £380K

Martin Paine & his wife also have approx. 9 other companies with their

names against but they are either dormant, dissolved or whatever.

Martin Paine certainly appears to do a lot of ducking and diving

Sorry, Circle Residential Management Ltd should read Net Worth of £1.1M

Can admin amend my error by any chance and then delete this post

Many thanks

No matter how many observations are made with regard to this situation, the long lease was designed by freeholder for freeholders, hence the money making elements contained therein.

Making unreasonable amounts ofmoney from leases is in direct opposition to the fundamental right of leaseholders, that of ‘reasonableness’ but how do you balance this with the right to make a profit, however obscene this may be and something the lease allows to occur?

From my own perspective of working for the Directors of the RMC that own the freehold of the block of flats in which I live, any money made from the areas of the lease that allow this are ploughed straight back into the building, enhancing the value of the interests of all who own a flat here (and this includes ‘rogue landlords of which we have a number).

LKP are doing a great job of highlighting abuses within the leasehold sector but perhaps they should be putting as much effort into promoting Commonhold?

Hi,

I just heard about this on R4.

Can I suggest the flat owners set up a FB page and twitter account?

It would be easier to alert more people (esp in Birmingham) and gain support. I will share widely with my friends for sure.

Just reading this and I am totally disgusted by the behaviour of these two high-way robbers. I think they need to be exposed on a current television programme maybe Inside Out BBC?

This is a real eye opener.

My sympathies to all involved.

Just reading this and I am totally disgusted by the behaviour of these two high-way robbers. I think they need to be exposed on a current television programme maybe Inside Out BBC?

This is a real eye opener.

My sympathies to all involved.

Do you have the right to manage?

The right to manage was granted in a change to leasehold law in 2002 for blocks with at least two flats. It enables leasehold owners, who generally hold the majority of value in the property, to take responsibility for the management of their block.

The process is simple and usually costs about £500. The landlord or freeholder’s consent is not required, but notice must be served on the freeholder. The right to manage company must then appoint a managing agent with professional indemnity insurance to act on their behalf. To find out more about right to manage, visit the Leasehold Advisory Service website at: lease-advice.org, or call 020 7374 5380

Read more: http://www.thisismoney.co.uk/money/mortgageshome/article-1611394/Fight-back-against-rogue-freeholders.html#ixzz40FKpLLnC

Follow us: @MailOnline on Twitter | DailyMail on Facebook

The right to manage (RTM) info is welcome though it doesn’t help with a ground rent problem caused by a monetising freeholder.

We obtained RTM at our development a few years ago and promptly had to put service charges up as we undertook repairs to the fabric of our building which had gone to rack and ruin in the care of the landlord and his own managing agent.

All they were ever interested in was in charging as much as possible for the least amount of effort; and given a commission based management fee it was in their interest to cause large repair bills.

Our bills will eventually go down. However, we remain vulnerable to various other kinds of monetisation by the freeholder. The tricks pulled by or on behalf of someone who owns one half of one percent of the equity in the building to maximise income, which is then sent to entities in the Carribbean, never cease to amaze.

Leasehold remains a cesspit of corruption, double-dealing and predatory behaviour. It is not just tolerated, it is effectively condoned by the Conservative party which prefers to look the other way and which recently lobbied the EU PRIVATELY to exempt Bermuda and the British Virgin Islands from crackdowns on tax havens which it called for PUBLICLY.

The continuing refusal to legislate reform may lead in the end to change at the point of a pitchfork, and, if so, when it happens there will much gnashing of teeth and wondering why LKP, Campaign against retirement leasehold exploitation and others weren’t listened to earlier.

Far fetched? Popular frustration with growing inequality and with rigged markets and political systems is growing globally and it WILL boil over in the West eventually if nothing is done (That which is unsustainable tends in the end to be unsustained, and all that).. Smart capitalists like Nick Hanaeur have been saying it for some time.

Who said:

There is no prouder word in our history than “freeholder”.

It was Margaret Thatcher. I don’t think she had the kind of monetising freeholder whose exploitative behaviour has been documented here in mind. Time for the Conservatives to wake up and smell the commonhold before the tumbrils arrive — or maybe just because it’s the right thing to do if they’re capable of acting on that.

A very interesting comment. I personally agree with you: public confidence in the free market being remotely fair is at the lowest ebb I have ever known it.

This is a view common to the young, who have material grounds to feel it, and the old, who don’t being the richest pensioners ever, but have the age and experience to know that things should not be like this.

The National Crime Agency figures from the Land Registry on offshore owned property assets beggars belief. Property Week’s crunching the figures to reach a total of £263 billion of commercial and residential assets held offshore is astonishing (echoed by Private Eye, which has a slightly lower figure).

The British are utterly mad to put up with this nonsense, especially when many of own fellow citizens are unlikely to be property owning at all.

The view that the market is basically rigged against the small, middle and the comfortable but not that comfortable is widespread.

It has been addressed in highly disillusioned terms by the irreproachably conservative Charles Moore, the biographer of Margaret Thatcher.

The rebellion against inequality and rigged markets and politics is growing. It’s covered in The Week with respect to Donald Trump’s supporters here: http://theweek.com/articles/605312/conservatives-have-failed-donald-trumps-supporters. I think it’s relevant to the Conservative establishment on this side of the Atlantic too. It’s sleepwalking toward the cliff.

Bernie Sanders supporters look like outmatching Hillary’s Wall Street donors and are overwhelmingly younger. His agenda will outlast his candidacy whatever the outcome..

Reform, including reducing the ability of rich to buy elections, rig markets and hide wealth in tax havens, cannot be put off indefinitely.

When reform is refused for long enough the correction ends up being explosive.

Would the charities here be happy to associated with such a company and appear on their website? Has anyone contacted the charities?

http://www.circlemanagement.co.uk/charitable-support.html

Macmillan Cancer Support

Starlight

Comic Relief

Sue Ryder

Children in Need

Breast Cancer Campaign

Winston’s Wish

Scoo-B-Doo

Goedgedacht Trust

British Red Cross

Canine Partners