Rendall & Rittner, a leading managing agent, boasts to leaseholders that it does not take commissions on block insurance, but it does own an offshore ‘captive’ insurance company in Guernsey that routinely makes a 40% profit on premiums.

LKP has been contacted by concerned leaseholders, and the issue was raised with the Financial Conduct Authority by LKP attended by the three APPG co-chairs – Sir Peter Bottomley, Justin Madders and Sir Ed Davey – on April 26.

Last Friday the FCA, which has also been contacted by legal academics over build warranty inadequacies, issued two statements Buildings insurance for leasehold properties and Leasehold Buildings Insurance which are, in effect, a rebuke to the insurance sector in leasehold.

“Depending on the contract of insurance and the circumstances, firms may owe some obligations directly to leaseholders. For example, if a leaseholder has direct rights to bring a claim under the policy, firms would need to consider whether they are arranging insurance that is consistent with their obligation to act honestly fairly and professionally, in the best interests of the leaseholders as well as the property owner (the ‘customer’s best interests’ rule in ICOBS 2.5.-1R).”

Experts in the insurance field believe leaseholders have more “direct rights to bring a claim” than is generally appreciated – and considerably more than the standard brush-off, relied upon by property managers and freeholders game-playing the leasehold sector, that as they are not a party to the insurance contract they cannot press their complaints. (This will be addressed in more detail by LKP in a subsequent article).

Buildings insurance for leasehold properties

In recent years, the cost of buildings insurance has increased significantly for some apartment buildings, especially if the building’s exterior is clad with potentially combustible materials. This has led to a rise in charges for some leaseholders. Insurers and insurance intermediaries should consider the value of these insurance products for customers (including any policyholders who could bring a claim under the policy).

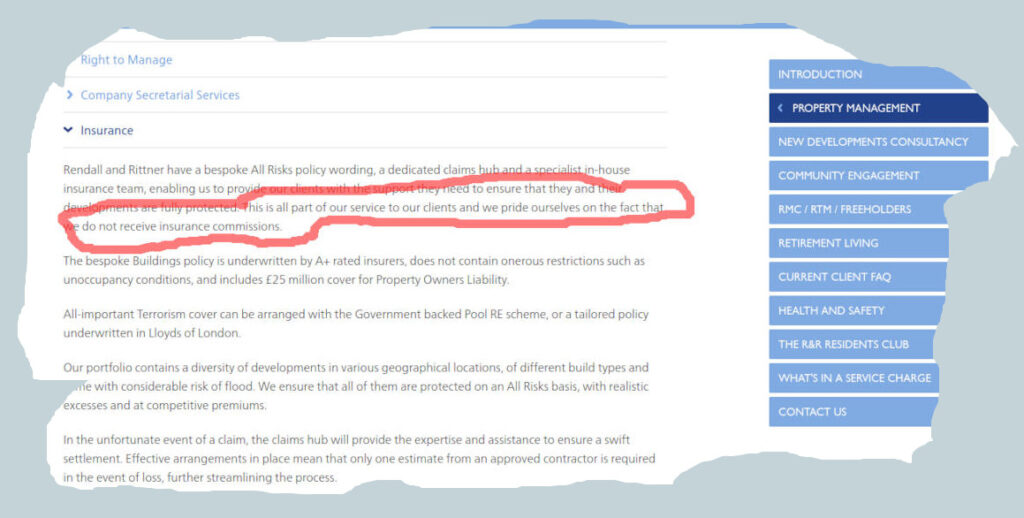

Rendall & Rittner, which is owned by R&R Residential Management Limited, says on its website “… we pride ourselves on the fact that we do not receive insurance commissions”. But the same groups also includes a captive insurance company based in Guernsey, Artex Insurance (RR4) IC Limited, that routinely turns in an approx 40% profit every year since it was set up in 2015.

Artex makes clear that its business is based on an alternative to commissions by underwriting some of the risk.

Leaseholders argue that there is no risk involved in this re-insurance business with AXA, which according to the accounts routinely over-pays for re-insurance with Artex.

The use of captives is well established in the insurance market, but they are owned by the insured who pays the premium, so they are handling their own money. The concern here is the use of captive insurance companies owned by agents/intermediaries, which inevitably gives rise to apprehension of a conflict of interest.

Artex’s document “An Alternative Approach to Commission for Property Owners & Managing Agents says:

“Managing insurance placement on behalf of tenants can be an important revenue stream of commission-based income for both property owners and managing agents. Many organisations are making strategic decisions to move away from risk-free income in response to commission disclosure proposals [FOOTNOTE 1] which has resulted in an increasing demand to create innovative structures that allow revenue to be generated from block insurance policies.”

Footnote 1 explains: “Proposals include the OFT and CMA studies and the release of ARMA-Q”

Leaseholders who have contacted LKP see this as acknowledgement that “innovative structures” are a work-around to the scrutiny of regulators and the ARMA Q ethical guidelines of Rendall and Rittner’s own trade body, ARMA.

Indeed, Rendall and Rittner seems to have some concerns about the offshore nature of this business as evidenced in p37 of its Financial Statement 30 June 2020 when it considers the tax position of its offshore company’s profits. “The company is taking further advice and subject to that advice may approach HMRC for confirmation”.

LKP has asked Rendall & Rittner whether it has sought the advice of HMRC and what was the result.

It did not address this, but after emails exchanged with co-founder Matt Rittner, which included the substance of this article, it provided a statement saying that “[we] believe a captive structure provides better alignment of interest between our customers and ourselves, removing the perception that we have no incentive to control claims tightly, a criticism frequently made of commission-based arrangements”.

Rendall and Rittner added: “We are surprised that LKP and the APPG are allowing themselves to be at all distracted by this aspect of the insurance market at present, when the overall cost of insurance has risen enormously as a result of the perceived risks of insuring buildings with fire safety issues, nothing at all to do with the captive solution …”

Rendall and Rittner’s full response is below:

Loading…

Loading…

However, the Guernsey Financial Services Commission and the International Association of Insurance Supervisors have concerns about “Producer Owned Reinsurance Companies (PORCs)”, such as captives operated by property managers to purchase insurance contracts with other people’s (leaseholders’) money.

The Guernsey Financial Services Commission “Guidance note on producer owner (re) insurance companies” is blunt:

“A client buying insurance cover where a PORC (Producer Owned Reinsurance Company) or POIC (Producer Owned Insurance Company) structure is present can be recommended by the producer to purchase a particular policy because it will generate an underwriting profit for the producer’s company and not because it is the most suitable policy for the client. The producer could also cherry pick the best risks for its own PORC and offload the poorer risks to other carriers. They have also been used in fraudulent schemes where the PORC structure has been deliberately misused.”

The International Association of Insurance Supervisors (IAIS), based in Basel, is wary of such captive insurers, too, in its Application Paper on the Regulation and Supervision of Captive Insurers (November 2015):

“Producer-owned reinsurance companies (PORCs) are captives, or cells of protected cell companies, that are beneficially owned by the producers of the business that is ultimately reinsured into the company through an independent fronting insurer. There are additional risks associated with these companies since the producer could be in a position to influence the placing of business with its own captive and could control the level of premiums or commissions that apply.

“There may be a need for additional corporate governance and transparency requirements to apply to PORCs to mitigate the risk of abuse.”

And here is Managed Risk Insurance PCC Limited in its document Property Insurance: Potential savings and profits from Captive Insurance happily acknowledging the financial benefits of landlords operating insurance captives to avoid disobliging scrutiny by FSA (now FCA):

“The commission earned from insurance premiums is sometimes used by landlords to help reduce property management costs. There is however an increasing move on the part of the Financial Services Authority to establish commission transparency, right through to the property tenants, who pay the premium. Whilst this is not imminent we believe that this will happen in the forthcoming years. The use of a captive cell can be an ideal way to maintain this stream of income for the landlord.

“Whilst commission earned on insurance premiums may represent a possible cost saving, captive insurance provides an additional potential source of return for property owners and managers.”

Rendall and Rittner reports the insurance results on p36 of its Financial Statement of 30 June 2020: a profit of £830,455 out of a premium income of £2,063,688, ie a 40% profit, very much in line with the previous five years.

A loss ratio (the % of claims/premium) of around 60% is very impressive indeed, compared with Lloyd’s property re-insurance which made a loss of £441m in 2020, with a loss ratio of 110%.

But leaseholders question whether Artex is bearing any risk on the basis of Rendall and Rittner’s Financial Statement as a reinsurance contract at a premium higher than the maximum payable indemnity is a risk-free transfer of money. Of course, even if Artex were bearing any risk, the conflict of interest concern would remain.

The Rendall and Rittner Financial Statement of 30 June 2020 – continuing an ongoing pattern since 2015 – shows that Artex retains a £1.1 million aggregate on the £2,063,688 reinsurance premium paid by AXA: so AXA has paid a reinsurance premium that is substantially higher that maximum annual aggregate indemnity it might receive from Artex.

So, Artex appears to be taking no risk with this re-insurance and that it is basically a work-around to achieve a 40% commission that has resulted in £2.75m risk-free profit over five years.

Some of these issues were raised by the leaseholders at Millennium Quay, in Deptford, south east London, and are shown in the minutes of the Millenium Quay (Blocks A, B, C, D, E, F, and G) Management Company Limited of 29 January 2020, which Matt Rittner attended as company secretary and, in fact, handled “the procedural parts of the meeting” – ie chaired it – according to the minutes.

It was explained to the leaseholders by the directors of this company, that Lockton insurance brokers are instructed via Rendall and Rittner “to conduct a wide market exercise every three years”. The arrangement showed that using AXA via Rendall and Rittner / Artex resulted in “terms that were £21,945.11 more competitive than any of the 13 insurers approached and £50,511.24 more competitive than the most expensive”.

According to leaseholders, Mr Rittner was asked whether the risk of Artex was capped, to which he replied: “Yes, of course it is.” He was asked whether he would say what the cap limit was, but declined to do so.

Leaseholders believe there is no risk of loss by Artex, confirmed by the stable 60% loss ratio over five years.

They believe that they are paying too much for insurance using Rendall and Rittner’s re-insurance scheme through its company Artex.

However, there is a view among leaseholders that Rendall and Rittner’s involvement in a re-insurance arrangement in placing the insurance and processing the claims is unfair.

On March 12 Matt Rittner and Duncan Rendall sold their interest in R&R Residential Management Ltd and from March 25 Wexford Bidco Limited, believed to be representing Swedish private equity investors, is now the person of significant control.

While Mr Rittner and Mr Rendall owned 42.5% each of the company another 15% was owned by Heritage Corporate Trustees Limited, an offshore entity that is referenced in the Panama Papers. We asked Rendall and Rittner to draw our correspondence to the attention of its directors.

LKP to monitor bank exposure as cladding flats sell to cash buyers in auctions

LKP to monitor bank exposure as cladding flats sell to cash buyers in auctions

The rendall and rittner problems are deeper than told. Allowing the gov stasi to move into appartments, hack into the fire alarm system, the security entry system, are part of there mass surveillance program. I thought it was only in chelsea bridge wharf, but appears to be country wide.

Thank you LKP for publishing this and highlighting R&R’s shady business tactics.

Our recent building insurance at Aberfedly Village (Oxbow) increased by >100%, following a Building Reinstatement Cost Assessment (BRCA) that was commissioned by an ‘independent surveyor’.

More needs to be done to stop managing agent like R&R.

Pedro, this is not just Chelsea Wharf. There is an ongoing collective petition across 19 developments in London that are managed by Rendall & Rittner. This alone speaks volume.

Developesters and Managesters of London/UK

Since 2012. Rendall and Rittner are beyond scandalous and sadly protected by the landlords, like St James, Berkeley Groups, Barrat, bellway etc as all of the big developers and their ” prefered managing agents” are into extracting money from Leaseholders only, regardless of morals, ethics or pandemic, money First. before 2008 we had Banksters, now we have got

Developesters and Managesters

Even by building cheap defective structural buildings and trying to pass the super expensive repairing cost as service charges in leaseholders budget, no wonder why many former directors of the latters are now directors of the developers or vice versa. can the management agents act without the landlord? of course NO,

in North London well-known Development of 5 Storeys Buildings, in the budget of 2014/2015, we asked them why the insurance is 40 % up, Rendall and Rittner’s immediate answer was” building terrorism premium” how such a premium is requested? it s a safe development under 18 m height Blg, far from train stations and airports or even highways.

the answer is Exactly in this report Thanks LKP, 40 % TAXES Free Commission.

it s time for the UK gov to break up the monopolist developers, like bellaway, Berkeley groups, Barrat, St James, etc. and their alternative businesses into small competitive businesses.

resulting in more healthy businesses and a fairer society and eradicating the super bonuses of ground rent, and draconian leases.