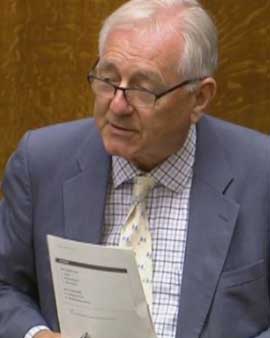

Sir Peter Bottomley writes:

I have just raised leasehold abuse with Sajid Javid, the Secretary of State for Communities and Local Government, in the UK House of Commons chamber:

“To get the supply and demand into balance, Mr Speaker, that requires successful developers and confident buyers. Will my Rt Hon friend get in the owners of the freeholds who are making a misery of the lives of the people who have leasehold houses and the developers who are trying to put these things right? People like Adriatic, I think, frankly, are looking like modern day robbers.”

“To get the supply and demand into balance, Mr Speaker, that requires successful developers and confident buyers. Will my Rt Hon friend get in the owners of the freeholds who are making a misery of the lives of the people who have leasehold houses and the developers who are trying to put these things right? People like Adriatic, I think, frankly, are looking like modern day robbers.”

Sajid Javid: ‘Mr Speaker, first of all, let me take this opportunity to commend my Hon friend for the work that he’s done in this area, showing up the leasehold abuses that do take place, especially when it comes to buying new houses. He’ll know in the white paper that we’ve said we will be bringing forward proposals, and I can confirm to him that we will be doing that very shortly.’

You can read more about Adriatic on the Leasehold Knowledge Partnership website: https://www.leaseholdknowledge.com/tag/adriatic-land

LKP adds: The Adriatic Land portfolios of residential freeholds is owned by secretive private investors and are administered by Will Astor, founder of £1.3 billion ground rent fund Long Harbour.

Astor worked for six years for leasehold sector mastermind Vincent Tchenguiz, who was arrested – on wrong evidence – by the Serious Fraud Office in March 2011.

His father Viscount Astor attended the All Party Parliamentary Group on leasehold reform in December 2016. Hitherto, he had not displayed concern for young leasehold purchasers caught in onerous ground rent terms and similar.

So, to ask the Mrs Merton question: “Why is multimillionaire Viscount Astor attending a meeting to address the concerns of young leasehold buyers of flats and houses?”

Who are Dublin-based Boardwalk Finance DAC and Jetty Finance DAC? Why do they own freeholds to people’s homes? And why are they based abroad?

Who are Dublin-based Boardwalk Finance DAC and Jetty Finance DAC? Why do they own freeholds to people’s homes? And why are they based abroad?

The French Revolution against the Monarchy in 1789 was the start of the people’s uprising against the feudal system and subsequent interim Governments nationalised the great estates of the French Aristocrasy and sold the divided up estates under freehold title.

.The revolution ended in 1799 when Napoleon assumed power and becoming Emperor.. Later the Napoleonic code was introduced all over Europe and Commonhold is the norm for property tenure in Europe. wide.

England’s navy defeated Napoleon fleet at the battle of Waterloo in 1812 and so Napoleon never had chance to push the Napoleonic code onto the English and Welsh and rescue us from the feudal system which is now well past its “use by date”…

I know! I am listening to the prime minister right now, explaining why nurses have to make sacrifices and accept a freeze pay because we cannot afford to pay them. Yet they allow the freeholders and landlords to squeeze every penny out of their leaseholders/tenants. They are amassing all the wealth, ( after all we have to live somewhere right?) while the rest of us are suffering. Are these people even taxed properly?

You are right to ask ” Are these people taxed properly.” ?

The freeholders are constituted as limited companies and so enjoy lower rate rates

e.g corporation tax is charged at 20% after deduction of loan interest. Some big ground rent investment companies pay Nil tax for many years on their ground rent income. .

The Leaseholders have to pay 20% and 40 % tax on their annual job income and this tax is used to pay the upkeep of Parliament, the Courts , FTT and Judges etc which often make decision in favour of companies which don’t pay tax..

There is no tax relief given to leaseholders for interest paid for mortgage loans whereas freehold companies are allowed to deduct loan interest as an expense to reduce the profit figure before tax.

How can this be a fair situation ?. .

Also freeholders can put their legal costs as a legitimate business expense, while the leaseholder has to Magic up the cash.

Dodgy solicitors abound here, I have some interesting tales to tell if anyone is interested.

I am interested!!!

I ,too, am interested

I am putting all the the facts together and will see if any journalist is willing to investigate. Or do you think it would be better if I send the files straight to HMRC?

Both!

Write to HMRC to report suspected tax evasion.

HMRC won’t reply to confirm they’ve received your letter.

HMRC Fraud Hotline

Cardiff

CF14 5ZN

United Kingdom

Year end 31 Dec 2007 Accounts for Peverel Investments Ltd– Co No. 01769945

——————————————————————————————–

Directors : N Bannister FIRPM, K Rutherford FIRPM , M Gaston & W Procter (both appt.31 May 2007) SFM Directors Ltd (resign31 Dec2007)

Auditors : BDO Stoy Hayward LLP, Southampton

Bankers : Bank of Scotland, Edinburgh

Share Capital : £100

Turnover : £5,952,165

Profit : £575,256,139

Tax : £1,448,363

Dividend Paid : £791,756,470

Shareholder Funds at 31 Dec 2007 : minus £7.616 Mil.

Parent Co & Ultimate Control : Peverel Property Ownership Ltd & Euro Investment Overseas Ltd & Tchenguiz Family Trust.

Look: at the tiny tax paid : Company Profit £575 Mil Tax paid £1.5 Mil and Dividend £791 Mil.

The Company which received the “ground rent freehold titles” transferred from Peverel Investments Ltd is shown below:

Proxima GR Properties Ltd ( Co. No. 03829939). The annual accounts are filed at Companies House and the figures shown below are copied from those filed accounts. which anyone can access at Companies House Website .

Fixed Assets = Investment in freehold titles of blocks of flats

Turnover = Receipts from annual ground rents

Accounts Year Capital Fixed Assets Turnover Interest chges Profit ( Loss )

Dec 2006 12,000,001 116,127,238 – 6,757,241 2,668,168

Dec 2007 28,000,001 843,734,256 789,703 33,039,074 ( 42,117,818 )

Dec 2008 28,000,001 842,975,894 10,672,303 18,971,262 (18,194,546 )

Dec 2009 28,000,001 842,547,129 10,906,970 19,258,141 ( 8,052,786 )

Dec 2010 28,000,001 842,444,650 12,124,589 19,617,169 ( 6,989,484 ) N

Dec 2011 28,000,001 842,272,780 12,678,835 19,870,580 ( 7,053,833 ) N

Dec 2012 28,000,001 1,112,585,834 13,625,403 20,205,334 42,295,734 N

Dec2013 28,000,001 1,107,876,409 13,746,604 20,121,300 (8,192,123 ) N

Dec 2014 28,000,001 1,574,207,753 14.345,763 20,920.380 (130,550,325) N

N = The figure stated for “Current tax” in the annual accounts = Nil for most years.

My observations ( I may be wrong as I am not an accountant )

1. It seems that Proxima does NOT pay any corporation tax because it gets credit from losses reported by other companies in the group ( controlled by Euro Investments based in BVI ).

The reports do not identify if these tax losses are imported from other BVI Companies ? And the HMRC should be explaining why these accounts are fair to leaseholders who have to pay 20% and 40% rate on their job earnings ?

2. Freehold Properties should be valued on the exit “sale” value on 31st Dec of each account year and not based on “actuarial valuations”. The rising “ fixed asset” figure versus ground rent shows the rental yield is around 1% which is outside normal range of valuations for commercial property.

3. This company has reported having no employees . It collects ground rent and global consent fees through another company .

4. Its not clear if the money demanded for subletting consent is included in these company accounts but there have been many cases before LVT / FTT due to excessive charges demanded by their agent.

Can the APPG ( Leasehold Reform) ask another APPG ( for accountancy to analyse the Proxima Accounts .?

The Company which received the “ground rent freehold titles” transferred from Peverel Investments Ltd is shown below:

Proxima GR Properties Ltd ( Co. No. 03829939). The annual accounts are filed at Companies House and the figures shown below are copied from those filed accounts. which anyone can access at Companies House Website .

Fixed Assets = Investment in freehold titles of blocks of flats

Turnover = Receipts from annual ground rents

Accounts Year—Capital—-Fixed Assets—-Turnover—-Interest charges—Profit ( Loss )

Dec 2006—-12,000,001—- 116,127,238——6,757,241——2,668,168

Dec 2007 —-28,000,001—-843,734,256 —– 789,703 —-33,039,074—–( 42,117,818 )

Dec 2008—-28,000,001—-842,975,894 —–10,672,303—18,971,262—–( 18,194,546 )

Dec 2009—-28,000,001—- 842,547,129 —–10,906,970—19,258,141—–( 8,052,786 )

Dec 2010—–28,000,001—-842,444,650—-12,124,589—-19,617,169—–( 6,989,484 ) N

Dec 2011—–28,000,001—–842,272,780—-12,678,835—-19,870,580—-( 7,053,833 ) N

Dec 2012—–28,000,001—1,112,585,834 —-13,625,403—-20,205,334—– 42,295,,734 N

Dec2013 —–28,000,001—1,107,876,409—-13,746,604—-20,121,300—— (8,192,123 ) N

Dec 2014—–28,000,001—1,574,207,753—–14.345,763—-20,920.380—– (130,550,325) N

Here is another company which does not pay current tax : Bradmoss Ltd ( Co. 06031160 ) which also controlled by Euro Overseas Investments Ltd ( BVI Company.).

The figures below are copied from the annual accounts filed at Companies House.

Year —-Capital—Fixed Asset——Turnover—–Current Tax

2013—–£1——- 44.400,000——–999,718 ———Nil

2014—–£1——–74,089,070——-1,067,927———Nil

2015—–£1——- 68,600,000—— 1,057,853———Nil

2016—–£1——–79,700,323 ——-1,035,385———Nil