By Liam Spender

With energy prices sky-rocketing, Rendall & Rittner leaseholders will be concerned to learn that their managing agent receives £969,000 a year in commission on communal gas and electricity supplies.

According to a letter posted on Rendall & Rittner’s blog, the commissions are paid at the rate of 0.03 pence per unit (kilowatt hour) of electricity. Gas attracts a lower commission of 0.015 pence per unit.

According to the letter, Rendall & Rittner estimates it buys of 182 gigawatts of electricity and 282 gigawatts of gas each year. This gas and electricity is supplied to around 550 developments Rendall & Rittner manages.

The commission rates mean Rendall & Rittner collects £3,000 per gigawatt of electricity and £1,500 per gigawatt of gas. This works out at £546,000 in commission on the electricity and £423,000 in commission on the gas, a total of £969,000 a year.

A gigawatt of power is equivalent to 1 million units of gas or electricity. A gigawatt is enough power to boil around 330,000 kettles for an hour.

This gas and electricity is from the mains supply. These supplies heat and power communal spaces, run lifts, heat communal boilers and light communal paths and car parks.

According to its most recent accounts, in the year to 30 June 2020 Rendall & Rittner took in over £21 million in management fees. In the same year Rendall & Rittner also claimed over £660,000 under the government’s furlough scheme.

The gas and electricity regulator OFGEM deems gas and electricity supplies of this nature to be commercial supplies, meaning they are outside the government’s recently announced domestic price caps for gas and electricity. The new price caps are due to apply from 1 October 2022.

Commercial gas and electricity supplies are often arranged by brokers. The power companies pay commission, and sometimes introduction fees, to secure the business of these brokers. The cost is passed on as part of the unit price charged by the power supplier to end consumer.

The government has said that it will cap commercial electricity supplies to £211 per megawatt hour for electricity and £75 per megawatt hour for gas. This is equivalent to £211,000 per gigawatt hour of electricity and £75,000 per gigawatt hour of gas. The caps are to last at least six months between 1 October 2022 and 31 March 2023.

The capped commercial gas and electricity prices are roughly 4 times higher than they were in 2021. Prices have risen as a result of the Ukraine conflict. The recent slump in the value of the pound against the dollar is likely to further push up prices. Gas and oil are typically priced in US dollars, becoming more expensive as a result.

Wholesale electricity prices in the UK market are set by auction and at the cost of the most expensive supplier, usually gas. As gas prices have risen this has forced up the cost of electricity.

It is currently unclear how the governments proposed cap will be applied to communal gas and electricity supplies in leasehold blocks. The bills are paid by managing agents like Rendall & Rittner using service charge funds. Leaseholders often have to fight tooth-and-nail to be able to even see the invoices.

Rendall & Rittner claims this commission covers its costs of procuring the supply. At the average national salary of £38,000 (say £45,000 after employer national insurance and other costs), the commission would employ a full-time team of nearly 22 people.

Other managing agents operate communal heating and power systems in leasehold buildings. These are not connected to the mains supply. A recent press report by Martina Lees in The Sunday Times reports prices for some these systems increasing by 500%.

Communal heat and power systems are outside the price caps imposed by OFGEM on domestic supplies. The government promises that a fund will be set-up to help leaseholders benefit from the recently announced domestic price caps. It is unclear how that fund will work, or when it will start to operate.

The government is proposing to cap the cost of these communal systems in the same way as for mains-supplied domestic electricity. The new protections were expected to come in from 2024 as part of the Energy Bill.

The Energy Bill contained no equivalent proposal to cap the costs of mains communal gas and electricity supplies, potentially leaving consumers facing uncapped price rises and having to keep paying commissions.

Following the election of Liz Truss, press reports say that the government is abandoning the Energy Bill. It is currently unknown how, or when, the promised protection for communal systems will come in.

With prices rising and the government’s growing appetite to stamp out leasehold abuses in insurance, it remains to be seen whether the government will cap mains communal gas and electricity supplies, or whether they will act to ban commissions of this nature.

The electricity commissions are not the only commissions received by Rendall & Rittner. According to its accounts, between 2016 and 2020 Rendall & Rittner received £1.5 million in dividends from its captive insurance company.

The captive, incorporated in Guernsey in 2016, arranges buildings insurance for blocks managed by Rendall & Rittner, at a steady 40% profit margin. According to its most recent accounts, Rendall & Rittner has paid no UK corporation tax on the captive’s profits since 2016.

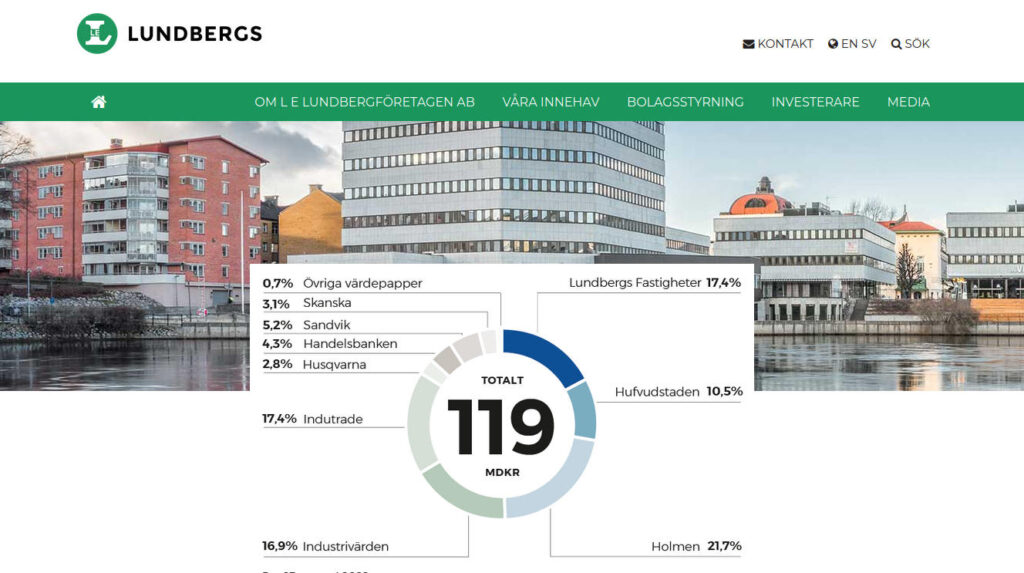

In 2021, Rendall & Rittner was acquired by a consortium consisting of the Swedish private equity fund Fidelio and family investment company L E Lundbergsforetagen AB. Companies House filings list Erika Martinson as controlling between 25% and 50% of the voting rights in Wexford HoldCo, Rendall & Rittner’s owner. According to Forbes magazine, Ms Martinson is a 14% shareholder in L E Lundbergsforetagen AB and is worth an estimated $1.8 billion.

https://www.lundbergforetagen.se/sv/vara-innehav

The price the Swedish consortium paid to buy Rendall & Rittner has not been disclosed. Companies House filings disclose that between March and July 2022 three different legal charges have been secured over Rendall & Rittner’s assets. Legal charges are the corporate equivalent of mortgages. The charge documents mention a syndicated loan arranged by Danske Bank, part of which appears to have been used to provide the money to buy Rendall & Rittner.

The 2020 accounts show Duncan Rendall and Matthew Rittner received £125,000 each in dividends up to 30 June 2020. A company controlled by the Rendall & Rittner executive pension fund received more than £76,000 in rent for a property leased to the Rendall & Rittner group. Both Duncan Rendall and Matt Rittner are beneficiaries of the executive pension fund.

In the year to 2020, the highest paid of the five directors of R&R Residential Management received salary and benefits of more than £214,000, up from more than £183,000 in 2019. It is not clear from the accounts if this salary package was paid to either or both of Duncan Rendall and Matt Rittner, but they were the only two directors of that company until others were appointed on 1 September 2020.

Rendall & Rittner’s explanatory letter to leaseholders is here:

FCA report on insurance in leasehold blocks: what does it propose and why does it matter?

FCA report on insurance in leasehold blocks: what does it propose and why does it matter?

R&R need to be audited by the government. They have raped leaseholders and deserve to be fined or forced to pay back money- white coloured crooks!!!

“white collared”

“The above pretty much

makes it definitively clear, why this laughing stock of an unregulated Industry sector needs getting a grip of by UK Law Makers, allegedly”

HMRC, VAT, and other Establishment figures please take note!

Is “Their any level that they will not stoop too” That will satisfy there greed for more money for private equality firms?

I don’t know how these companies are still able to reference affiliation to such high regarded organisations as ARMA, RICS, IRPM and Investors in People. What utter nonsense. If the article has the facts correct then the level of commission being extracted from the utility management is immoral. Tantamount to misrepresentation by issuing a letter with figures such as 0.3 pence per KW/hr to Leaseholders. Seems a reasonably low figure until it is multiplied by over 2000 units’ consumption. I would think that it is not in line with the ethics of each of the organisations and it is they who should investigate if their code of conduct has been breached and if found that it has, then the companies and the individuals should be stripped of their membership.

Nicholas,

I am afraid I cannot agree with you on ARMA and RICS being highly regarded, in my experience they were both completely useless and are part of the problem! I applaud Liam Spender in his very comprehensive articles bringing many issues to our attention which we would otherwise have no clue about!

Hear, hear! I could not agree more.

Will there be a stampede to investigate this firm by Arma, RICS, IRPM and Investors in People? I think not!

If my assumption is correct, no investigation will take. One possible reason not to investigate could be that the “code of conduct” was in no way breached. So, if the “code of conduct” was not breached, is the “code of conduct” worth the paper it is written on? allegedly

Peverel started this racket 30 years ago …

Something in one of the weekend newspapers about freeholders endangering the right to work from home for those who own(?) leashold properties. If lease prohibits using property for business purposes – as is often the case – then working from home contravenes lease terms it seems. And freeholders will, amongst other penalties, threaten forfieture.

I only skated over the story but I think I have the essence correct. The very fundamentals of this country are corrupt and very likely beyond repair in the near and medium terms. We have immediate crises like the cost of living, energy, and the immense one of a nuclear confrontation between NATO and Russia (due to Ukraine). We have a new Prime Minister who is beyond incompetent (to be blunt, she is as thick as shit) and driven by extreme right wing economics. Fat chance that leasehold, and other corrupt fundamentals, will be sorted this side of Armageddon.

Absolutely agree on every point you’ve made.

The communal water and sewage budget for Year ending 31.03.23, for this residential apartment block was £ 5,623.00 (copied over from the previous managing agents’ budget). Since we achieved RTM in March of this Year, it has been recalculated that the actual water and sewage bill will be less than £ 3,000.00 per annum. The apartment block occupancy rates remain at about 90%

The communal electric budget was £ 7,600.00 per annum (has above copied over) for Year ending 31.03.23, it is now estimated on actual usage, that the year-end figure will come in on, or under budget, despite soaring electric prices. We have taken some simple straight forward remedial steps to reduce electrical consumption but still cannot fully understand how we have achieved such a substantial cost down.

It would appear that by simply going Right to Manage that water, sewage and electric costs, reduce substantially over night.

One of my Neighbours recently commented that he felt that we had previously been charged “Twice for flushing the toilet”

“I was notified by the Managing Agent of our choice” two days ago, “that we had been paying 20% VAT on the communal electric bill, when in fact it should have been 5%”. We are in the process of putting this issue right.

It would appear that there may be similar issues with the communal water bill. Had we not achieved Right to Manage status none of this would have come to light, allegedly. The anticipated electric cost refund will be substantial and will go directly into the RTM Company’s reserve funds”

I wonder if “Highbury Stadium Square” will discover similar to the above, now that they have achieved “Right to Manage” If they do, seven hundred plus Shareholders have a very loud voice especially in the Capitol.

While government is not pressed into action to regulate leasehold, the ripping off of leaseholders will continue.

Totally agreed with the comments above. ARMA and RICS are just nothing more than just trade associations and will not take action on their fee-paying members. Why would anyone attack their members and lose your income unless a member has fallen so badly that they will only take action if it affects what little reputation they have? I’ve read that one of the MAs is on the board of ARMA. So much for looking after the interests of leaseholders or the public as they’re only interested in their bottomline.

As for the TPOS, they have no legal clout and are just as useless as the MAs they’re meant to oversee and keep these cowboys in check.

The whole industry needs a radical overhaul and have proper regulatory laws and enforcement and kick these useless trade bodies and the TPOS out of business.

It’s a matter of when the industry gets regulated, and not if, and we shall all hope that cowboy MAs like R&R get driven out of business.

I note that Rendall and Rittner are strongly denying that they get such commissions. Not that that means very much. But it seems the source is their own website (as per below) so not sure how they can deny it. I guess they have an alternative definition of ”commission” in this context (just as they do for buildings insurance)

Commissions

As part of our commitment to provide and improve our utilities service, Rendall and Rittner works on a

commission structure basis. The rates below will be included in the supplier’s pricing, at the point of tender:

• Electricity – 0.3 p per kWh

• Gas – 0.15 p per kWh

This level of commission remains the same as the previous two years. Commission is generated against the

consumption through each meter and is not impacted by changes in the wholesale price.