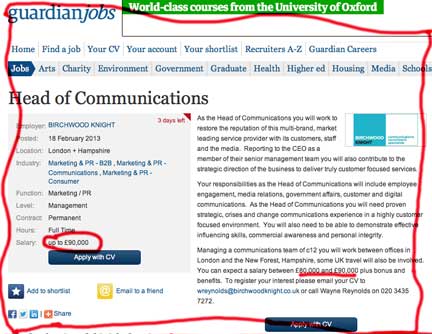

Can this be our old friends at Peverel tarting up their image in leasehold management by recruiting a ‘Head of Communications” for £90,000 a year?

Can this be our old friends at Peverel tarting up their image in leasehold management by recruiting a ‘Head of Communications” for £90,000 a year?

It sounds like it from the description …

“to restore the reputation of this multi-brand, market leading service provider with its customers, staff and the media”.

The job is based in London and New Forest and the new recruit will “need proven strategic, crisis and change communications experience in a highly customer focussed environment. You will also need to be able to demonstrate effective influencing skills, commercial awareness and personal integrity.”

Splendid. Only Peverel has to hunt with the hounds and side with the hare: its key customer is still the Tchenguiz Family Trust – the Tchenguiz brothers are after £300 million compo for their mistaken arrest in 2011 – that used to own it and which still controls up to 70 per cent of the freeholds it manages.

Ordinary leaseholders are insignificant by comparison, and are hardly “customers”.

Peverel has never been a customer focussed business. It is the creature of McCarthy and Stone, which took in over and then dumped it in the early 1990s when there was outrage at service charges.

John McCarthy, pioneer of the retirement leasehold business model, launched an £800,000 libel case against the Daily Telegraph, which spectacularly failed. It is thought among journalists of the time that the case cost McCarthy a knighthood.

Peverel was sold off to the same venture capitalists who own it now, and then sold on again to a management buyout, before being scooped up by Tchenguiz right at the end of the property boom in 2007.

Its business model has always been top down: given management contracts by developers not leaseholders. The McCarthy and Stone freeholds, now part of the Tchenguiz Family Trust, account for the bulk of these and then high-end London contracts followed during the boom from the likes of Barratt and the Berkeley Group – the latter also sold its freeholds to Tchenguiz.

The Tchenguiz, who still own one per cent of the country’s residential freeholds, brought them all under the management of Peverel in one guise or another. This was a shortlived union as the property crash – and the Tchenguiz arrests in March 2011 – pitched Peverel into administration.

Such is Peverel’s reputation that it has been dumped by Barratt, Berkeley and McCarthy and Stone. And residents at prime London sites – St George’s Wharf, Charter Quay, Chelsea Bridge Wharf, Marathon House – have also organised to get rid of Peverel.

It is unlikely that that top end business – for which ousted executive Lee Middleburgh had responsibility – is coming back. There are nuances to Peverel’s behaviour, however: it has not-resisted the right to manage at 288-unit Palgrave Gardens, near Regent’s Park in central London, in exchange for a one-year management contract. A similar arrangement exits at the massive 422-unit Metro Central Heights, south of the river at Elephant and Castle, which won RTM in November.

But the bulk of Peverel’s business is retirement leasehold and non-prime London odds-and-ends it picked up during the boom years. Both will continue to drain away as competitors that do not have a reputation in need of being restored enter the market and savvy leaseholders realise that there is an alternative.

Peverel has confirmed that it is appointing a head of communications.

LKP wins Best Online Editorial at LSL Property Press Awards 2013

LKP wins Best Online Editorial at LSL Property Press Awards 2013

Financially Electra are, of course, very much the junior partner to Chamonix (the fool in the deal? Sorry, I’ll get my goat). I doubt either have any clue as to the number of impending RTM actions. They’re desperate to play ball now with leaseholders because it’s the only chance they have!

Unless of course Vincentbaby wins big and leaseholders and other benighted taxpayers have to pony up so he can buy his toys back.

It is of interest to note Peverel feel the need to appoint someone to restore their reputation to the staff. whilst probably unintended this is the first public acknowledgement from Peverel that they have problems with their staff.

I am still awaiting confirmation from Peverel that this is their appointment.

This is an appointment by investors thinking like investors with solutions form a particular culture. For free, I could invigorate the company with the same advice I gave at its fall- back to basics. Focus on acting as trustees and stewards of everyone’s interests and address issues that need doing and enlarge the role and resources of the PM to address them. They need the Comms help, not to cross sell or asset manage, but build trust with residents and deliver on agreements made. Residents and PMs need to be allowed to cut loose from being tied to contractors and providers tied into commercial arrangements, whether that be insurers or window cleaners, and it must be said the banks. Retaining those arrangements is possible if the appointment is competitive and transparent.

When that is done, people perceive a good core service and don’t object to the asset management of fees here and there.