By Richard Murphy

The purpose of this article it to look at the proposals announced by the Government (7 January 2021) and help leaseholders make an informed choice of what the impact is going to be for them in financial terms. Should they wait for the changes to be implemented before seeking a lease extension or purchasing their freehold?

The press release headlines states:

Millions of leaseholders will be given the right to extend their lease by a maximum term of 990 years at zero ground rent.

Government reforms make it easier and cheaper for leaseholders to buy their homes:

Government reforms make it easier and cheaper for leaseholders to buy their homes

Millions of leaseholders will be given a new right to extend their lease by 990 years Changes could save households from thousands to tens of thousands of pounds Elderly also protected by reducing ground rents to zero for all new retirement properties Millions of leaseholders will be given the right to extend their lease by a maximum term of 990 years at zero ground rent, the Housing Secretary Robert Jenrick has announced today (7 January 2021).

A lease extension for a flat can dramatically increase its value, even for flats with long leases. Savills’ research has suggested (a bit optimistically I would say) leases with an unexpired term of 100, 90 and 80 years will increase in value by 5%, 7.5% and 10% respectively.

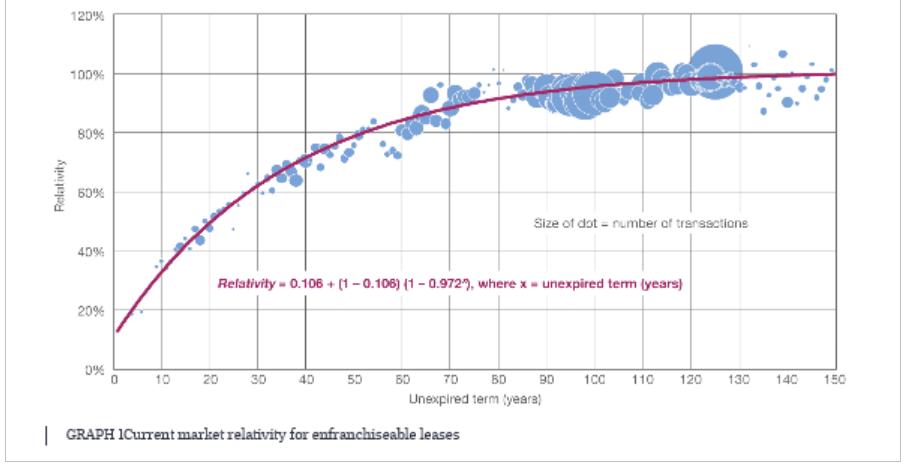

However, for leases above 130 years, any extra years will not add any value (See Savills Graph below).

Will these new changes make any difference given that Leaseholders already have a right to a 90-year lease extension at a zero-ground rent?

The 990-year lease extension proposal is a bit farcical, as in reality, most flats are unlikely to be around in 100 years never mind 990 years, whereas the existing rules allow for unlimited statutory lease extensions!

LKP does not agree with this. 999-year leases end games being played with lease lengths. After all this is a sector where a practitioners such as Martin Paine had the little wheeze – perhaps still does – of backdating aggressive ground rent terms of a lease extension to the date when the lease was first issued not from when it was extended, dumping quite poor families in properties with £8,000pa ground rents:

Affluent freehold-owning couple’s lease terms bring ruin to families who bought flats that are virtually worthless

Therefore, the extra 900 years is unnecessary to maximise the value of the lease.

Part of this is clearly spin as the right to a Zero Ground Rent already exists and has done for the last 28 years! These 2 reforms have been described as “window dressing”, look and sound very good but do not address any of the real problems in the current system.

On its own it will not make the process cheaper or simpler which was the stated purpose of these reforms.

Valuation Example

To illustrate these points, I have taken a flat worth £400,000 with 87 years unexpired, assuming a zero Ground Rent (to assist the illustration)

Under the existing rules, the premium for a new of 177-year lease would be £5722.

Comparing this to a valuation under the new proposal with a 990-year lease extension, the cost will increase slightly by £72 to £5794, without creating any appreciable increase in value.

Existing Valuation

| Reversion 1 | ||||

| Freehold value of flat | £404,040 | |||

| PV £1 in 87 years @5% | 0.014339 | £5,794 | ||

| Reversion 2 | ||||

| Freehold value of flat | £404,040 | |||

| PV £1 in 177 years @ 5% | 0.000178 | -£72 | ||

| Diminution of landlord’s reversion | £5,722 |

Proposed valuation

| Reversion 1 | ||||

| Freehold value of flat | £404,040 | |||

| PV £1 in 87 years @5% | 0.014339 | £5,794 | ||

| Reversion 2 | ||||

| Freehold value of flat | £404,040 | |||

| PV £1 in 1077 years @5% | 0 | £0 | ||

| Diminution of landlord’s reversion: | £5,794 |

If you have a lease greater than 80 years, should you wait for the government to implement these changes before applying for a lease extension?

- You are already entitled to a 90-year lease extension at a Zero Ground Rent, which will give you a lease of more than 170 years.

- As there is no timetable for the reform, it may take years.

- Waiting for the reforms while house prices continue to rise, and lease length continues to fall will lead to an increase in the costs for leaseholders.

- If the lease were to drop below 80 years, the cost of a lease extension would increase by more than 175% (assuming marriage value is not abolished at the same time).

Do not wait!

This is therefore a “no brainer” and if your lease is in this category, my advice is to get your lease extension carried out under the existing rules as soon as possible.

The Savills Enfranchisement Graph below shows leases above 130 years are very close to the Freehold Value.

Savills Enfranchisement Graph 2015:

The Press Release is contradictory and confusing, as it provides for ” zero ground rent” on “retirement properties”, all “homes” and then refers to ” a cap on ground rent”.

I suspect what is meant is as follows:

In anticipation of these rule changes the large developers had already adopted zero ground rents with 999 years minimum term, to ensure funding for government schemes going forward such as “Help to Buy”.

Leasehold scandal: ‘Massive’ breakthrough as UK’s largest housebuilder eliminates ground rents | The Independent:

‘Massive’ breakthrough as UK’s largest builder eliminates ground rents

Campaigners have hailed a breakthrough in the leasehold scandal that could help thousands of prospective homeowners after the UK’s largest house-builder eliminated ground rents on its new developments. Barratt Developments is beginning to offer 999-year leases and zero ground rent on new-build flats.

The press release also states:

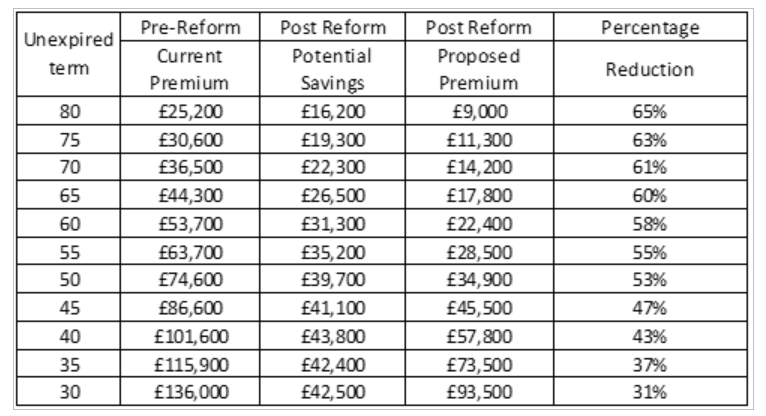

The government is abolishing prohibitive costs like ‘marriage value’ and setting the calculation rates to ensure this is fairer, cheaper and more transparent.

The abolition of Marriage Value is a game-changer as it would give huge benefits to leaseholders. I have prepared a table to show the likely impact on the cost of a lease extension for a flat assuming extended lease flat value of £400,000 (The percentage reduction can be applied regardless of Flat value):

However, when the Law Commission proposed this change, Catherine Callaghan QC, a human rights expert, was engaged to give an opinion on whether the various options would be lawful. She opined that the abolishing of marriage value had a slightly less than 50% chance of being in breach of the Human Rights Legislation for Freeholders.

Therefore, it is surprising that the government has chosen this option. I can foresee many challenges and obstacles to this reform before it passes onto the statute books (if ever).

This reform does not affect leases that are more than 80 years as marriage value is not applicable.

If you have a lease of 80 years or less, should you wait for the government to implement these changes before applying for a lease extension or completing on one?

The big problem with this reform:

• There is no fixed timetable for the changes to take place (if ever).

• It will be difficult to sell or raise money on flats that are not extended.

• Lease lengths are falling and if flat prices continue to rise without implementation, costs will increase for those that delay.

• Many Industry Professionals believe the reforms if implemented will only apply to “owner-occupier’s” and not investors.

Personal circumstances will determine whether you risk delaying or push ahead.

Some may say that when you purchased the property, you may have factored-in the cost of the lease extension. If so, rather than having the uncertainty, you may decide to press ahead.

As far as investors are concerned, where the reforms are less clear, the cost of a lease extension may be Tax deductible and have less impact (please consult an accountant for this advice).

It is a gamble whichever way you look at this.

With regard to Calculation Rates most valuers already adopt fixed rates on Deferment (5% for Flats and 4.75% for Houses as per the Sportelli Case)

I can envisage the calculator to work out the Reversion looking something like this:

There would of course be a separate calculation to Capitalise Ground Rent which could easily be incorporated to achieve a final figure.

My previous research would suggest the following multipliers could be used for most Ground Rents: –

Will you still need valuers?

Even if all the reforms are enacted, there will still be a need for a valuation of the flat, so that these percentages can be applied.

In the words of Mark Twain …… “Rumours of my Death have been greatly exaggerated”.

I would be interested to hear any feedback on this article and happy to hear from anyone interested in adding value to their flat by extending their lease or buying their freehold.

If you have any queries or concerns about this matter, please contact me at:

richard@richardjohnclarke.com or on Twitter @RichardMurphy1 and @RJC_Surveyors or call me on 020 7499 8043

Bankruptcies for leaseholders and billions entrusted to freeholders and their managers, APPG told

Bankruptcies for leaseholders and billions entrusted to freeholders and their managers, APPG told

Do you think widening the enfranchisement rights to shared owners will happen earlier than the reforms to enfranchisement costs?

Nothing is certain Adam and particularly that level of detail about when things will happen. I would assume that many of the major reforms requiring primary legislation will take a few years and are all likely to occur at the same time.

The announcement did indicate that ground rents will be set to zero, i assume on new leases rather than old ones, followed by further reforms “in due course”……

” Legislation will be brought forward in the upcoming session of Parliament, to set future ground rents to zero. This is the first part of seminal two-part reforming legislation in this Parliament. We will bring forward a response to the remaining Law Commission recommendations, including commonhold, in due course.”

Crikey, I maintain complicated centrifugal chillers and use various calculations, yet even now I’m at a complete loss on how to workout what a lease extension is likely to cost me.

120 years left on lease after initial 125 start.

300pa

Doubles every 25 years

Current value as per mortgage provider is £190,000

Subject to Contract and Without Prejudice

Ball park figures only….

300 x 19 = £5700

plus about 0.5% of the value of your flat

Say £7000

plus professional fees

It will save you a fortune in ground rent if you plan on staying around for the next 120 years😁

Thinking of more of a leg up for my son via inheritance.

Appreciate you taking the time to reply. £7000+fees (ballpark) I can stomach. 👍🏻

What would be the approx lease extension cost for:

RPI linked GR 291 every 10 years, property value £203,500. 106 years remaining on lease

Would this be typically for a 90+ year extension to achieve zero ground rent,

I need to get the GR to zero or to 0.15 property value in order to agree on a sale that’s imminent but the buyers lender is objecting to the GR terms

0.1% I meant

As a valuer working in this field I have to say that I disagree with quite a lot of what Richard Murphy says.

I would argue that the devil is in the detail, and that the only certainty is each day that passes your lease gets shorter.

If personal circumstances mean that there is no rush, and you trust the government to enact legislation that shifts massive amounts of wealth from rich freeholders to ordinary leaseholders, then you should probably wait.

If you need to move forward now, or you are shortly to drop below 80 years, or you don’t trust the government to be willing and able to find the time to enact the legislation that they say that they intend to enact, then you should probably get on with things ASAP.

I think that there is an argument that government have been deeply irresponsible in making an announcement which puts leaseholders in a very difficult position. Impossible position.

Hi James

I don’t quite understand why you are saying you disagree with me when we appear to be saying the same thing for leases over 80 years

“Do not wait!

This is therefore a “no brainer” and if your lease is in this category, my advice is to get your lease extension carried out under the existing rules as soon as possible.”

Richard

I said that “just over” 80 years unexpired I cannot see that waiting is a risk worth taking… longer leases (87 or 95 or 103 year leases which will need extending some time, and normally the advice to get on with it if you’re going to do it sometime) it may be a risk worth taking to wait. But I categorically am not advising these people to wait, just saying that it might be worth waiting.

Likewise under 80 years – it might be worth waiting, but I am sure as hell not going to advise anyone to wait given that the only reason to wait is because you trust the current government to do the job they have promised to do.

I disagree when you say “However, for leases above 130 years, any extra years will not add any value (See Savills Graph below).” Whilst I agree in literal terms, extending a 130 year lease might increase your sales price, dependent on the buyer who likes your flat the most. And adding value is irrelevant in my opinion – if you are a 30 year old investor for life with children then why not extend a 130 year lease rather than do it in 40 years time when it costs much more.

Everyone’ circumstances are different.

“The 990-year lease extension proposal is a bit farcical, as in reality,” I disagree – the point is to make sure that the reversion is worthless and always will be so long as anyone you might care about is alive.

“On its own it will not make the process cheaper or simpler which was the stated purpose of these reforms.” Agreed – but they have said that they’ll address that as well (which brings us back to the question of trust in the goverment. If you trust the government then wait, if you don’t, or aren’t sure you can, then go ahead!)

“Under the existing rules, the premium for a new of 177-year lease would be £5722.

Comparing this to a valuation under the new proposal with a 990-year lease extension, the cost will increase slightly by £72 to £5794, without creating any appreciable increase in value.” I think that this paragraph is meaningless given that you haven’t got the small print of the new proposal. Other things will change – they might push costs up or down, but government says down, so if you trust a government run by a proven liar then you should wait.

“The Press Release is contradictory and confusing, as it provides for ” zero ground rent” on “retirement properties”, all “homes” and then refers to ” a cap on ground rent”.” I think they mean zero new ground rent in all new leases, plus a cap on ground rent taken into account for calculation purposes (ie landlords who imposed onerous ground rents don’t benefit from the onerous element). Educated guess.

“The abolition of Marriage Value is a game-changer as it would give huge benefits to leaseholders. I have prepared a table to show the likely impact on the cost of a lease extension for a flat assuming extended lease flat value of £400,000 (The percentage reduction can be applied regardless of Flat value):” It might not be a game-changer if it is replaced with hope value respect of marriage value at 99% of what marriage value would have been!

“Personal circumstances will determine whether you risk delaying or push ahead.” I agree, but I’d argue “Personal circumstances and how much you trust the government will determine whether you risk delaying or push ahead.”

“It is a gamble whichever way you look at this.” Arguably those are the only words that any valuer can say with certainty!

“Even if all the reforms are enacted, there will still be a need for a valuation of the flat, so that these percentages can be applied.” Not necessarily. The freeholder and leaseholder may be able to agree without a value. It may be related to the last sale and an index. Who knows.

James

Always good to hear from you mate.

Look forward to meeting up in the future when we get out of this mess.

Cheers Richard! I didn’t mean to be too critical! We are all wandering round in the dark here, and at the end of the day all we can do is guess.

Hi James you seem to know what you writing about, can you comment on my situation:

What would be the approx lease extension cost for:

RPI linked GR 291 every 10 years, property value £203,500. 106 years remaining on lease

Would this be typically for a 90+ year extension to achieve zero ground rent,

I need to get the GR to zero or to 0.15 property value in order to agree on a sale that’s imminent but the buyer’s lender is objecting to the GR terms and is holding up the money!

0.1 % I meant

Let’s not forget the many older leaseholders that have lived in the property for 40. + that were unaware or still unaware that they even needed to extend their lease. Many of these purchased with already low leases, again unwarned by their solicitor . Now each day that passes their lease extension gets more unaffordable and out of reach to them. Their properties will be reclaimed by their landlord when the lease runs out. If they are ‘lucky’ they will be allowed to stay in their home when this happens and pay the going rent, again an unaffordable figure. What on earth can these leaseholders do?

Apart from pay for a lease extension not a lot. If you have equity you could sell and extend simultaneously and move somewhere cheaper. It all depends on what equity you have in the property. One of my 1st clients, who was in her 80s had only 25 years left on a 3 bed duplex in Onslow Gardens, South Kensington .She sold it and bought a flat with a long lease in Notting Hill.

However not everyone is that lucky and I appreciate many flat owners are trapped. It maybe worth discussing with your family who may ultimately be the beneficiaries if that’s a possibility.

Yeah but who would buy a property with only 25 years lease, someone with cash no doubt, no lender would touch it surely.

I have a £250k leasehold flat with 54 or so years outstanding. Extension to an additional 99 years was quoted at around £32k a couple of years ago.

I have been hoping that leasehold reforms would result in my paying substantially less than this huge amount of money, so I have been holding on in the hope that some substantial changes will take place.

This article therefore disappoints me greatly.

I suppose that given the governments performance in dealing with the cladding issues, where loss of life is a possibility, that should be an indicator of how well and quickly they will reform leasehold. Meanwhile extension costs are ratcheting up.

It is outrageous, absolutely outrageous…

Agreed. Good luck.

“Part of this is clearly spin as the right to a Zero Ground Rent already exists and has done for the last 28 years! ” Does this only apply if you are having your lease extended or is there a way for me to remove the £100 a year now? Thank you

Hi Toshiro

You can only reduce the ground rent to zero by extending your lease with a formal lease extension, unless your Freeholder is prepared to do an informal deal with you.

I have two retirement flats left to me by my husband which are rented out.

McCarthy & Stone keep asking for a percentage of the rent payable to them each year when tenancies are renewed and a percentage payable to them when I sell them. They are only worth the same amount as my husband paid for them years ago. Is this lawful for McCarthy & Stone to claim these amounts of money?

Only if it’s in the lease

Exit fees that are clearly explained up front should result in the flat being sold for less and therefore it would be reasonable for the freeholder to claim the exit fee when sold

Sometime the service charges are subsidised with the account being topped up by exit fees – these are very difficult to challenge as the lessee enjoys the subsidy of exit fee from previous leaseholders and can’t really object to the fee when their time comes to pay

Again and again it is the failure of the purchaser and their professional advisors who act on the purchase to consider what the impact is of having a ground rent and exit fee – the Government need to obligate the developer to show clearly in the front part of the lease what the NPV is of the ground rent and the terms by which it is reviewed along with any exit fee- on the front part of the lease – prescribed clauses and not buried in the lease – in that way a purchaser can make an informed decision and offer accordingly on the property – so exit fees are ok but must be spelt out clearly before a purchaser commits to the lease

I extended my lease about 2 years ago, but still charged ground rent by the landlord. I was not aware and nobody in the process told me that the ground rent could be eliminated. Is it too late to claim this possibility, please?

If you used the formal statutory process the ground rent is reduced to a peppercorn. In an informal lease extension, many freeholders opt to retain a ground rent. You should check with your lawyer as it sounds like you have had an informal lease extension. If this is the case , then you can only reduce the ground rent to a peppercorn by agreement with the freeholder or making a statutory claim,

Hi

I have been in contact with the freeholder about a lease extension ( 44 years remaining) and was informed the lease extension would be cheaper if the ground rent increased from £14 to £250pa and increase £250 every 25 years . What should the discount be for lease extension with the increased ground rent in relation to a extension with no ground rent as the freeholder will be making a considerable amount of money on the ground rent.

Hi Gordon

Approx 19 x £250= £4750.

What is this 19 figure you refer to?

Richard – what’s your advice for people thinking of buying a flat? For example we are looking at a flat (outside of London) value £325,000, lease length 132 years, ground rent currently £250/year but due to increase to £500 per year in 7 years time.

What are our options?

Hi Iona

It depends on how long you are planning on keeping the flat.

Ideally its best to get buy out the ground rent by doing a formal lease extension. Ideally the seller would serve the notice so it can be assigned to you on completion. This saves you from having to wait 2 years.

Thank you Richard. We intend to keep it a good few years. How much would the extension cost and how long to extensions usually take? Should the seller pay for it?

Hi Richard,

Your article helps, but unfortunately it does come down to trust in any government – especially when institutional freeholders with deep pockets will be able to fight it for years.

My lease is unfortunately at 67 years so I have thought about waiting for legislation to change… however the possible ‘Hope’ value (seems to be skipped over by most) is even more frightening! I have a top floor flat (converted house) and at the time of purchase discussed development into the roof – and also altered my lease to have the right to build a terrace onto the flat roof of the rear room of the ground floor flat – both never done due to lack of finances.

If I wait for the marriage value to be better ‘managed’ (scrapped), I could end up paying more under ‘Hope’ for something which is possible but may never happen! – or be locked into a reversion agreement which, after buying my freehold, if I (or a subsequent owner) do later develop, we then have to pay a sum to the ex-Freeholder (or their children’s children)!?!

What if a homeowner, who has bought their Freehold off the developer under ‘Hope’ rather than ‘Marriage’, wants to build a conservatory? Or a block of Freehold/Commonhold flats (again under a new reversion) wants to add a top-storey flat and share the sale proceeds – either they won’t ever have the option or will have to pay the ex-Freeholder for the privilege?

Have I understood this correctly – is this ‘Hope'(less) situation actually possible? If so, how on earth did this get introduced as part of the ‘fix’ – surely not nominated by Leaseholder groups?

(I will now take a breath!)

Richard

As ever, a well constructed piece for which I thank you. I have been mulling over an idea for some time and I have never yet heard it mentioned among the illuminati – why not remove the iniquity of the Value of Act Rights deduction (probably by Statutory Instrument) right now and save the tenant an instant bundle ?

In my opinion trusting a Tory government to legislate against ‘their own’ is a forlorn hope. As Lord Greenhalgh prefaced his recent remarks in the HOL ~ “My Lords, first of all I point out my residential and commercial property interests as set out in the register” ~ Well, I guess he did at least declare them…

Stay well